When good is not enough: Tackling psychological barriers to success

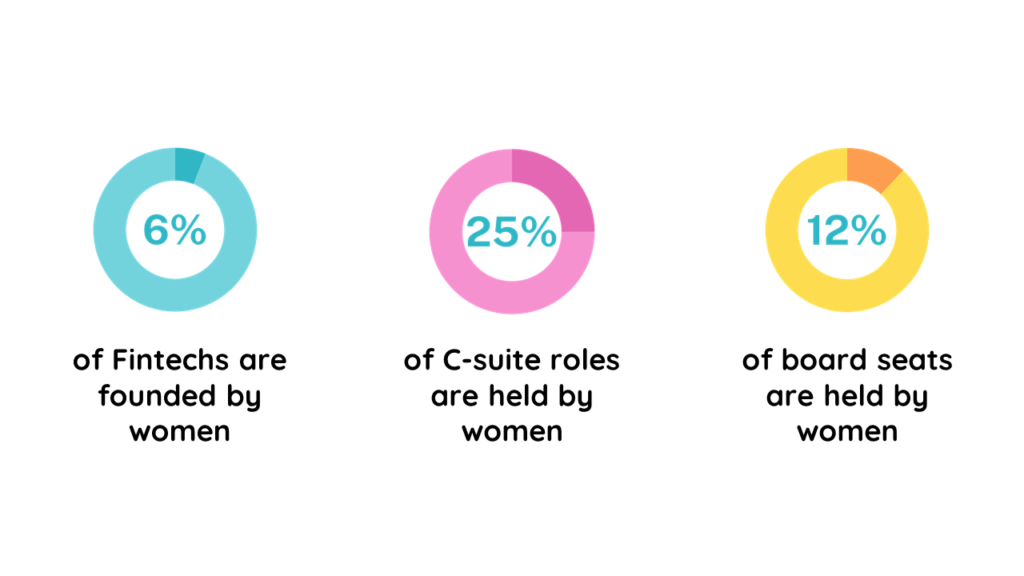

Women’s equality makes good economic sense. In a study of over 350 startups, Mass Challenge and BCG determined that businesses founded by women deliver higher revenue – more than two times as much per dollar invested – than those founded by men. Yet, despite the overwhelming evidence in favour of female leadership, early research from our Fintech Diversity Radar has shown that just 6% of fintechs in Europe, Middle East & Africa, and the Americas, are founded by women.

As part of our study for the Fintech Diversity Radar, we have spoken to a multitude of female leaders about their experiences in the fintech industry. Throughout these conversations we saw the same theme emerge from women across all backgrounds and regions: the psychological barrier of self-censorship.

Self-censorship, or “the exercising of control over what one says and does,” can be caused by a range of different factors, including family dynamics, gender expectations and race. From hiding career breaks to downplaying ambition, the practice seems common across all industries, including fintech. So what are the psychological barriers that women are tackling, and how can fintechs help to overcome them?

Too ambitious, or not assertive enough?

According to Forbes, female leaders are often affected by a double-bind bias, or a mismatch of what is expected of a leader and what is expected as a woman. Those who are not assertive may be well-liked, but perhaps not considered leadership material. On the other hand, women who display traditional “masculine” qualities can sometimes be labelled as unfeminine and aggressive.

Such duality was present in a PWN study in 2018. The study indicated that while 88% of women have set themselves ambitions, 77% see those ambitions as “taboo”. Conversely, the same survey also showed that 58% reported having been criticized for being soft spoken or “not assertive enough”.

This double-bind bias can be seen through our ongoing conversations with female leaders and founders for the Fintech Diversity Radar. An anonymous executive in the financial services industry told us of her own experience in dealing with these gender stereotypes. She explained that as a woman, “it has been very tough to sail a boat in the rough sea if you have an aggressive and bold personality.”

Gendered ageism – a sting for young women

Compounding the double-bind bias is the risk of gendered ageism, particularly for young women. A recent report by FN London makes for disconcerting reading for female graduates; one senior investment banker advised, somewhat contentiously, for younger women to look for a back-office or support role.

Indeed, according to McKinsey, women in entry-level roles in financial services seldom envision themselves in a top executive position; only 26% aim for this goal, as compared with 40% of their male peers and 31% of entry-level women across all industries.

Monica Eaton-Cardone, COO and Founder at Chargebacks911 & Fi911, describes concealing her own age and job title when starting her career, for fear of bias: “I realised as a woman I just don’t have that instant credibility,” she explains. “In order to land the deal I had to get through the door, and if the problem to get through the door was because I was the wrong sex, I had to figure out a way.”

Setting the bar for working mothers

One of the concerns cited by entry-level women is balancing family and work commitments. As Joanne Dewar, CEO of Global Processing Systems (GPS), describes, women set “an impossible bar for themselves” to be “the perfect partner, parent and career executive.” This fear, coupled with lack of support for women returning to the workforce after a career break, can cause some women to self-censor their choice to raise a family.

Dewar describes how, after coming back from a 7-year break, she was reluctant to disclose the fact that she had been out to raise children. “It’s about organisations creating the opportunity,” she urges. “There are still too few returnship opportunities out there where you can return to full-time employment and a role that could grow in time as you find your feet again.”

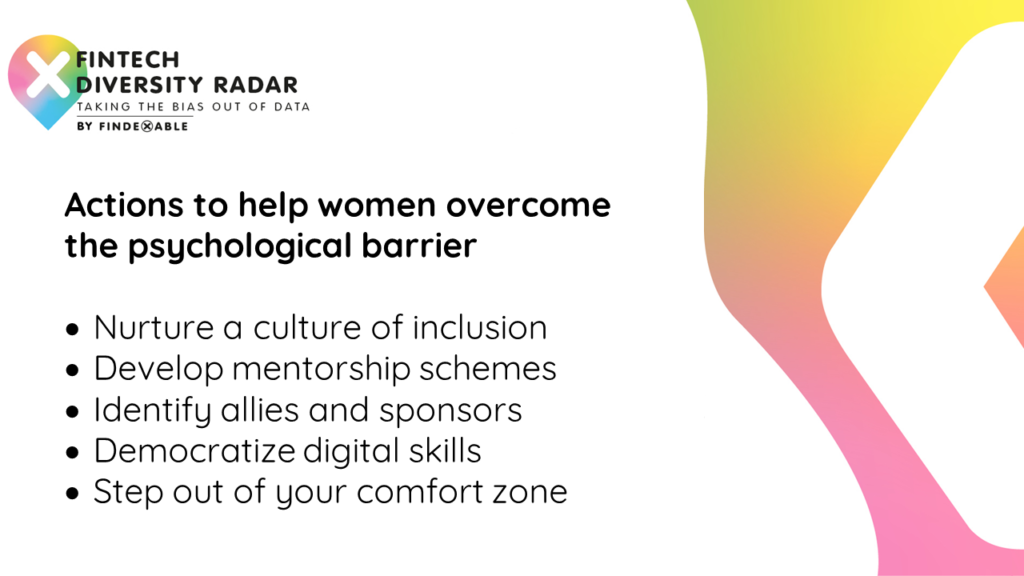

Actions to help women overcome the psychological barrier

With a rapidly evolving business landscape post-Covid-19, there is a clear opportunity for fintechs to make meaningful and lasting progress on diversity, inclusion and equality (DI&E). In our research and conversations with female founders, we identified five considerations to help women overcome the psychological barrier to success:

- Nurture a culture of inclusion

- Develop mentorship schemes

- Identify allies and sponsors

- Democratize digital skills

- Step out of your comfort zone

Nurture a culture of inclusion

As disruption occurs across industries, new ideas are needed from more diverse perspectives to help companies become more innovative and competitive. Interestingly, some of the women we’ve spoken to for the Fintech Diversity Radar highlighted the distinction between diversity and inclusivity. An anonymous female executive commented: “Most of the time, people hire a female associate in the name of diversity; however, at work they are not included. For me, inclusiveness is more important than diversity.” Indeed, according to a 2018 report by Bersin and Deloitte, companies with inclusive cultures are 8x more likely to achieve better business outcomes.

Develop mentorship schemes

One way that female leaders and fintech organizations can create a culture of inclusion is to focus on supporting and uplifting young women in their career. Eaton-Cardone explains that mentorship schemes, like the LIFT scheme at Fi911 (sister company of Chargebacks911), are essential in building working relationships and challenging unconscious gender bias. “Mentorship for aspiring leaders can improve their confidence, help them build a strong network, and encourage self-advocacy,” she explains, “all of which are key tools for advancement.”

Identify allies and sponsors

Male leaders also have a part to play as sponsors and allies to their female counterparts. Dara Tarkowski, managing partner of Actuate Law and chief innovation strategist of Quointec, believes the more that women can connect with people in their industry, regardless of gender, the better. “Aligning with allies is critically important in financial services,” she says, “[particularly] the right male allies who align with your professional goals and personal values.” Corporations such as American Express and Bank of America have created programs that accelerate the progress of women and people of colour by pairing them with more experienced sponsors who help them learn the ropes.

Democratize digital skills

We can expect the pandemic to widen the skills gap, with a particular shortage of talent in technical areas. As we build the digital post-Covid world, fintechs should look to democratize digital skills to help women fully participate in the post-pandemic economy. For GPS, creating “returnship roles” for people coming back from parental leave is critical to helping women (and men) assimilate back into an alien environment. Annette Evans, Vice President, People and Culture at GPS, told Findexable: “providing women with opportunities to succeed in both their professional and personal lives has always been embedded in our culture.”

Step out of your comfort zone

To address the balance and increase the proportion of female leaders in the industry, women must also give themselves the power to be heard and accepted, even if it does mean stepping outside of their comfort zone. Tarkowski advises that women can’t wait for opportunities to be given to them. “If you see something available to you, I would encourage every single woman to be brave and speak up,” she says. “Ask for a favour, ask for an introduction, ask for a meeting. Be gracious, but don’t be afraid to ask.”

Monica Eaton-Cardone discusses self-censorship in the early stages of her career

Joanne Dewar explains the challenges of low self-confidence when returning to work after a career break

At findexable, our mission is to help provide a transparent global benchmark for diversity in fintech to create a more equitable future. If this sounds like something you would like to be involved in, then take the Fintech Diversity Radar survey here.