Fintech in 2022. The i’s have it

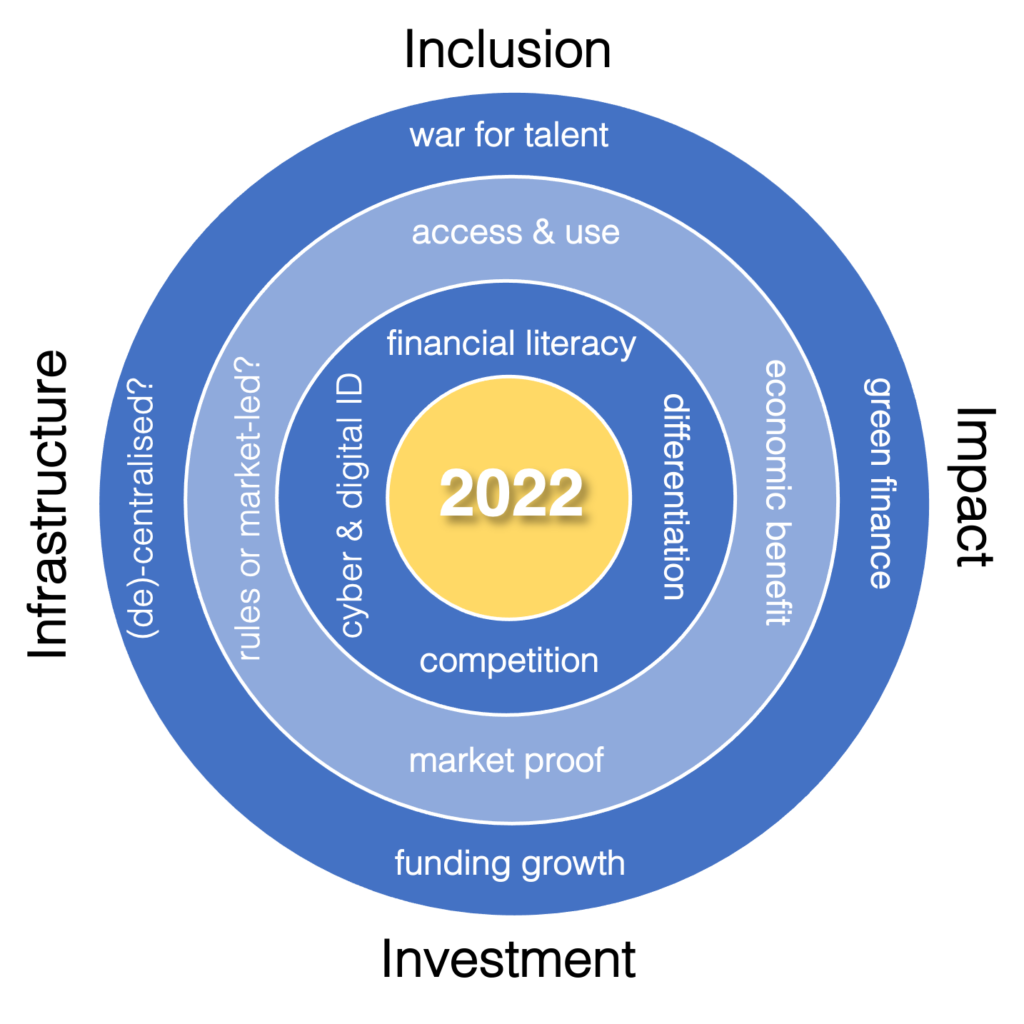

There might be only one ‘i’ in fintech but there are 4 in 2022. Competition for market proof, efforts to capitalise on a new generation of financial services customers and a war for talent will concentrate the minds of investors, innovators, traditional institutions – and governments this year

Simon Hardie

The predictions business is a murky one, especially when a pandemic continues to cause global uncertainty, but after fintech’s banner year in 2022 – record levels of venture investment and over double the number of unicorns birthed in 2021 than the whole of the previous decade combined – this year’s fintech story will be dominated by 4 pillars and related themes.

Flag 1.

All in the i’s: fintech’s defining themes in 2022

source: findexable, January 2022

1. Inclusion – Me 2.0

Despite the severe economic impact, particularly in emerging regions, increasing financial inclusion has been one of the surprising upsides of the pandemic. As governments around the world reduced barriers to make it easier to accept digital payments and mitigate some of the downsides of stay-home orders, fintech innovators everywhere proved their validity – in many cases working together and directly with governments to help support small businesses or improve access to government subsidies. In doing so many firms proved the recipe of user experience, business model and product that fintech success takes.

In 2022 as fintech’s ‘pandemic dividend’ starts to unwind two interconnected inclusion-related themes will be important drivers for the sector:

- Improving diversity across the industry that currently appears to have a systemic gender problem (findexable Diversity for Growth Report 2021).

- Educating and supporting new generations of fintech customers – many of whom will be first-time users of financial services as a whole (not just customers that have fully migrated to digital banking).

Why?

Record levels of investment will mean unprecedented pressure to scale putting the war for talent at the top of management agendas – compounded by an acceptance that remote working is here to stay. At the same time with women and poorer communities most affected by two years of a pandemic tech firms will be under increasing pressure to reassure governments that they’re doing what they can to build inclusive, future-fit workforces.

So?

Firms that can prove commitment to a cause bigger than themselves (see next pillar below) such as genuine efforts to improve the diversity of their teams – or supporting new and first time users of fintech to become long-term customers by helping them build financial wellbeing stand the best chances of building sustainable, scale businesses.

Who’s doing this well so far?

- Nubank, Brazil (IPO December 2021)

- Chime, USA

- Zepz, UK

- Jumo, South Africa

- Asyx, Indonesia

2 – Impact – What are you doing?

If proving your fintech firm is fighting for a cause all sounds a bit 1960s, the coincidence is not err… coincidental. Climate change, record levels of distrust of government and the long shadow of the financial crisis cast, not to mention the economic pressures on the middle class in developed markets is driving consumer suspicion of the motives (and value(s) of big business and government everywhere.

Fintech, in its own way borne out of a troubled over-centralised financial system, can be an antidote, or at least partial remedy to some of society’s ills but it will take leadership to communicate – and disciplined orchestration to prove it.

How?

It’s not just a PR exercise. With fintech proliferating rapidly in every region of the world and sphere of the marketplace, and compounded by record levels of funding, competition between fintechs and incumbents will heat up dramatically in 2022 – even more so if interest rates go up, supporting bank balance sheets.

Fintech firms will need to prove to customers that they exist for a reason beyond making them and their investors wealthy – whether that’s to build financial wellbeing (become their provider of choice), contribute to greening the planet (climate awareness) or improve access and convenience at lower cost (financial inclusion).

This will matter as much at the regulatory level as with customers. The Global Fintech Index added 50 new fintech ecosystem cities to the Index in 2021 – with more anticipated this year. For fintechs to thrive no matter what region they’re located in they’ll need to get better at proving to regulators and government that they’re contributing to society’s greatest challenges, not exposing us to unidentified risks, and why the regulatory environment should support their existence.

Who’s doing this well so far?

Mambu (banking infrastructure), Germany

Brex (small business finance), USA

Bima Mobile (health insurance), Sweden/ UK

Jefa (financial inclusion for women in Latin America), USA

Evergrow (Sustainability – first dedicated carbon offtake company), USA

Oko ( insurtech for agriculture), Israel

3 – Investment – What are you (really) worth?

After a bumper year for investments in 2021, expect more to come in 2022. Tiger Capital has already confirmed it has raised its largest-ever fund for tech investments and we’d expect other large venture and private equity funds to follow. According to our FinteCorn Tracker – launching next week – more than double the number of fintech unicorns were born in 2021 than in the previous decade combined.

Download our Fintech 🦄 tracker

Sign up here to receive a copy of the Fintech Unicorn Tracker when we launch next week

But high valuations are double-edged. Great for headlines and ‘pre-IPO’ proof of concept – but less reliable as bellwethers for future value generation or growth. Remember the challenging stock market debuts of PayTM in India or Marqeta and Affirm in the US?

Why?

By the end of 2022 it will be nearly 15 years since the start of the Global Financial Crisis that inspired the fintech boom. Ballooning funding rounds mean blooming expectations – and with the number of fintech firms globally showing no signs of slowing, expect plenty of investors to start asking where their money went – and for market consolidation to be a theme later in the year. Neobank anyone?

Where to invest?

It won’t all be about the pressure to perform. Cyber and identity technology, regtech and green fintech will prosper this year as the world continues to move online, and privacy, environmental and societal concerns impact purchasing and regulatory decisions. And don’t be surprised if a DeFi use case blows up the cryptosphere setting the scene for blockchain to finally break into the mainstream (while still small relative to global financial services assets, the market cap of DeFi assets in January 2022 is 8 times larger than a year ago).

At the other end of the spectrum banks everywhere will continue to ramp up their investment in digital transformation – creating more pressure for fintechs in countries with banks that are managing to pull it off – and a different kind of pressure for bankers that aren’t managing to reignite customer excitement or engagement from their digital initiatives.

Who went public – and who’s going?

IPO’s in 2021

Affirm, Blend, Coinbase Global, dLocal, Marqeta, Moneylion, PayTM, Robinhood Markets, SoFi, Toast

Anticipated IPO’s in 2022

Chime, USA (low cost banking)

Klarna, Sweden (POS credit)

Plaid, USA (open finance)

4 – Infrastructure – How do we build it?

Bank digital efforts are great news for fintech makers of core banking infrastructure who can expect plenty of interest from banks around the world. Perhaps even a record year for the segment if interest rates continue to go up in favour of incumbents.

Why?

Similarly for cyber and identity companies expect the zoom-phone to be ringing off the digital hook – the number of cyber and security breaches grew by 50% between 2019 and 2020 and with more firms and more digital only customers than ever, firms of all sizes and ages will be prioritising enterprise security and customer privacy. With increased regulatory scrutiny to match.

It won’t be just private sector finance that will be looking at the impact of a post pandemic customer on their survival. Government and regulators will shift their focus to protecting customers today to building the regulatory infrastructure for the future.

Mark Zuckerberg’s preoccupation with the Metaverse to one side (for the moment), at least 60 countries globally are some stage along the open banking journey – whether discreetly or implicitly. At the same time 18 of the central banks of the G20 are actively exploring their own digital currency, not to mention the now more than 250 cities that are home to fintech hubs, and cross-industry experimentation with decentralised finance, fintech will be at the top of government agendas in 2022.

Who’s doing what?

Among the priorities will be the interventions needed to profit from a tech, talent and digital dividend without loosening control on the levers of power – or consumer protection – and the role of fintech in driving digital transformation. Some highlights for the global regulatory calendar below:

Saudi Arabia: Open banking laws coming in to force.

Mexico: Announcing plans for a central bank digital currency by 2024.

Colombia: Forming a regulatory framework for voluntary open banking due to come into effect this year.

Kenya: The Central Bank of Kenya’s National Payments System Vision and Strategy 2021-2025 seeking to moderniseThis seeks to modernise the payment landscape including open banking.

There will be more to come – and expect plenty more discussion on management, treatment and classification of cryptocurrency and digital assets.

How well the sector fares and in which regions the sector flourishes will largely depend on how well the market can respond to the other three pillars above.

Happy 2022. And here’s to a pivotal (new) year.