Secrets of Nordic fintech success

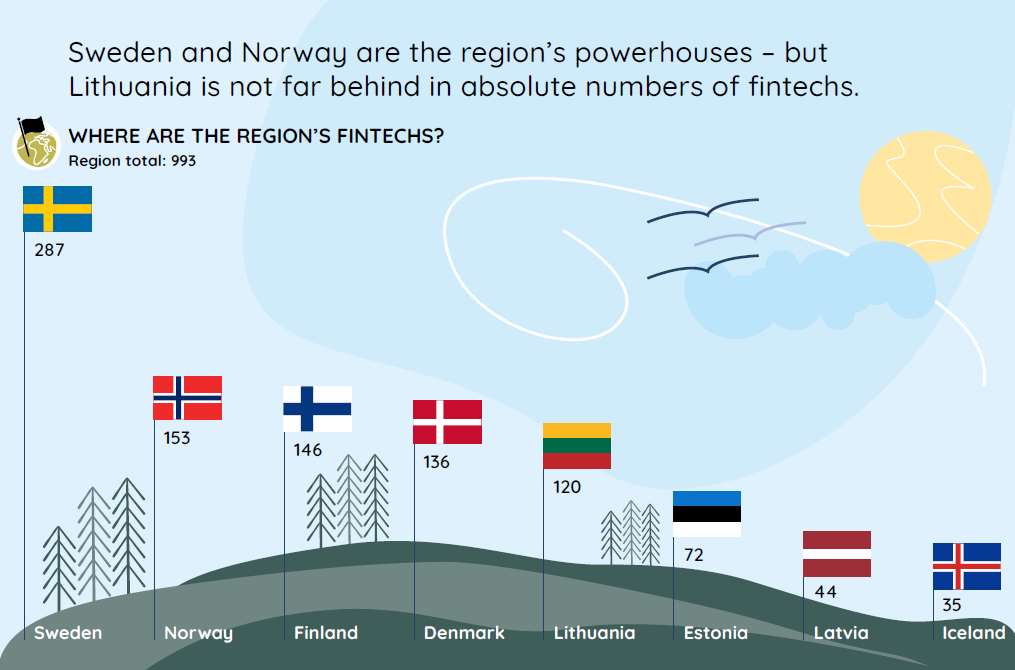

Home to one in ten of the fintechs listed on the Global Fintech Index by findexable, the Nordic and Baltic countries are where some of the biggest names in financial technology first came to prominence: from Klarna and iZettle to Transferwise and Tink, all of which have their roots in northern Europe.

“The ambition to scale is absolutely there among Nordic fintech companies”

Siri Børsum, Huawei. The Nordic Report by Fintech Mundi and findexable is live

There are three primary reasons for the outsize success of the countries of the Nordic and Baltic region — home to close to 1,000 fintechs while representing little more than 2% of the population of Europe:

1. It’s early success — particularly in the Nordics — at moving away from cash

2. The region’s embrace of collaborative models for the development and distribution of financial services long before fintech became every bank’s favourite bandwagon

3. Commitment to digital services and the digital economy

Although it may sound simplistic, these three principles underpin many areas of the regional economy — and perhaps unwittingly have created the foundations for a thriving fintech ecosystem.

When combined with strong IT infrastructure, healthy national economies, and financially literate, highly-banked populations — there’s little surprise that, over the last decade the region has become a testbed for the future of financial services and a live experiment of how collaboration between policymakers, finance and entrepreneurs could shape how we manage the economy of the future.

This new report,Striving, scaling or sailing? explores the breadth and dynamics of the region’s fintech industry — and what signposts there are for the future of financial services.

Under-weight but over-achievers

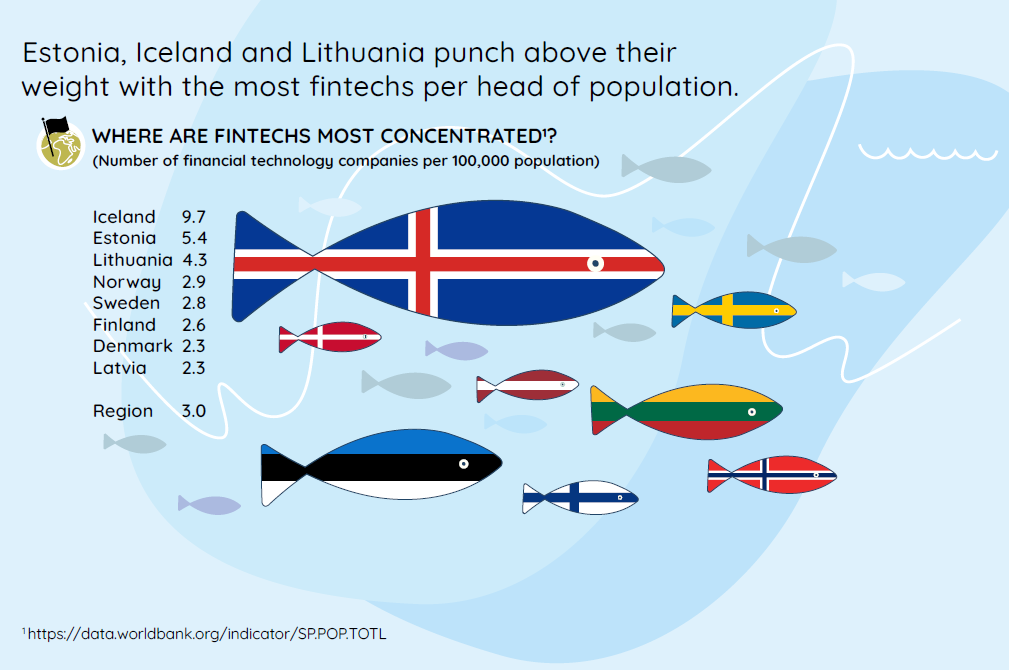

Behind the big names and celebrated unicorns lies a diverse and innovative marketplace. A region where size is no obstacle to success or ambition. Indeed smaller countries like Latvia and Estonia punch above their weight in areas like cryptocurrency and blockchain, and Lithuania’s ecosystem saw the country appear as fourth globally in the first global fintech ecosystem rankings this year.

Karen Heskja, BDO. Nordics and Baltics — Striving, Scaling or Sailing?

Deep roots

Given the history and the typical development of fintech globally, it’s unsurprising that providers of payments and transaction services continue to thrive across the region. Using data collected from the Global Fintech Index and insights from a wide range of more than 30 interviews across the ecosystem, the 2021 Nordic Report, explores the data behind the success — to identify how and where fintech is concentrated across the region, what fintechs are doing, and the local infrastructure that supports them.

Terje Ennomäe, Feelingstream. Nordics and Baltics — Striving, Scaling or Sailing?

But, as you will see in this report, the underlying conversation is bigger than fintech alone. The repercussions of the pandemic, a naturally collaborative culture, and a powerful cocktail of finance and digital acceleration can put the region at the forefront of the drive to a sustainable economy with a careful hand at the wheel. Indeed — less striving, and perhaps, smoother sailing.

Download The 2021 Nordic Report Striving, Scaling or Sailing?

For more information and insight — get in touch with us

Download The Global Fintech Index 2020 City Rankings Report