World-Leading Financial Centres Missing out on Fintech

8 of the World’s top financial centres drop out of new listing of top 20 fintech hub

Start-up hubs don’t equate to fintech hubs a new fintech index shows – over 80 cities score lower for fintech than for generic start-ups

The Americas lead but Europe’s class shines through

Many of the cities which traditionally top the lists of leading financial centres are conspicuously absent from a new league table of global fintech hubs. Financial giants such as Frankfurt, Shanghai and Zurich have been replaced by cities including Sao Paulo, Bangalore, Mumbai and New Delhi.

Top of the Global Fintech Index City Rankings 2020 is the San Francisco Bay area, followed by London, New York and Singapore. The United States also tops the list for fintech countries followed by the United Kingdom and Singapore. Lithuania, a country with a population of about a third of that of London, lies fourth in the global list thanks to its active encouragement of fintech companies and regulatory approach.

By country and region, the USA and the rest of the Americas form the biggest single area by number of fintech hubs. At the same time Europe’s diversity of centres (both old and new), its commitment to progressive regulation, and to ensure that rules are applied evenly, contribute to its position as the region with the second highest number of hubs globally.

The Global Fintech Index City Rankings 2020 identifies emerging hubs, fintech companies and trends. The Index algorithm ranks the fintech ecosystems of more than 230 cities across 65 countries incorporating data from global partners including StartupBlink, Crunchbase and SEMrush.

Simon Hardie, CEO and Founder of Findexable – the company behind the Ranking explained: “The Index is the inspiration of thousands of hours of interviews, surveys and internet searches – and the product of four months of algorithm development to create, for the very first time, a fully global ranking of fintech countries and cities.

“The rankings in the report are proof of how much, and how fast, the world is changing.”

Fintech is the electricity of the global digital economy – making connections and making it easier and cheaper to transact for more people in more parts of the world than was ever possible before.

Keeping up with the pace of change, and keeping track of progress, however, is essential if fintech’s innate digital difference is to be successfully converted into real-world value.

For the purpose of the Indexalgorithm fintech is any business that applies a technologically enabled innovation specifically geared for the provision or distribution of financial services.

The country and city rankings are calculated from a total score comprised of a combination of three metrics:

Quantity – Size of fintech ecosystem and supporting structures – number of fintechs, fintech hubs, co-working spaces, accelerators, global influencers and population (countries only)

Quality – Impact/performance – size and growth of fintechs (eg number of unicorns), investment, events, value generation, international collaboration, website ranking

Environment – ease of doing business, critical mass, regulatory environment – regulatory interventions to improve competitive environment, incentives for start-ups, internet censorship, payment portals, fintech courses.

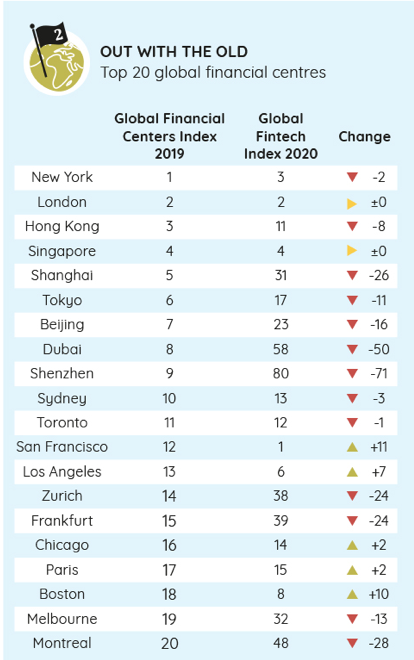

A comparison between the Global Fintech Index City Rankings 2020 and the most recent Global Financial Centres Index shows the varied success of different cities (chart right):

Simon Hardie added: “The rankings are evidence of a worldwide de-coupling between the financial strength and the commercial domination of traditional financial centres. Financial wealth is no guarantee of a city’s status as a fintech hub. You might call this the rise of non-traditional finance.

“There are some common features of winning fintech hubs around the world. Fintech-friendly regulations incentivise entrepreneurship and encourage investment. A strong talent pool is also key to fintech success together with an ecosystem where people can connect easily.”

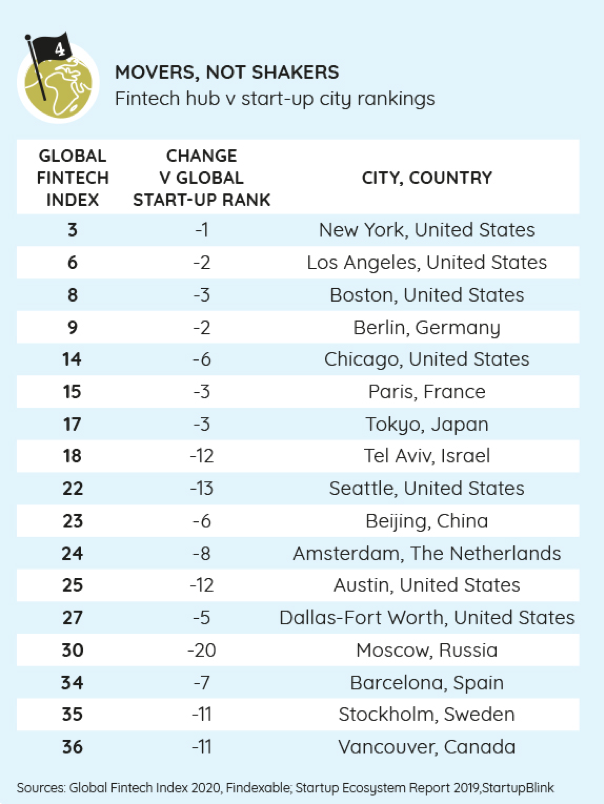

One of the most interesting outcomes from the launch of the Global Fintech Index City Rankings 2020 is the breaking of an assumed link between a city’s status as a start-up city and its position as a global fintech hub. As this year’s rankings show, a city’s start-up status is only a reflection of the strength of its fintech community. The terms fintech and start-up are not interchangeable.

While established global start-up centres like London, New York and San Francisco – all retain or improve their positions at the top of the rankings – others do less well. Among the top 40 fintech hubs tracked by the index, nearly half are in a lower position as a fintech hub compared to their ranking in global start-up indices.

This table below shows the comparison between fintech hub and start-up city rankings.

Hardie added: “Keeping up with the pace of change, and keeping track of progress, is essential if fintech’s digital difference is to be successfully converted into real-world value. We created the Global Fintech Index City Rankings 2020 to help fintech founders, and the ecosystems they’re based in, reach their goals.”

Download the Global Fintech Index City Rankings 2020: http://bit.ly/2020GFI

For further information on Findexable and the Global Fintech Index City Rankings 2020, contact Findexable MD Denise Gee at denise@findexable.com or Tel: +44 (0)779 376 8109.