Top 10 payment trends in the 20s

Global Fintech Index City Rankings Report 2020

Payment Trends: Transactions = innovation

Access and support for electronic transactions is a pivotal factor in the success of building dynamic fintech ecosystems. Everywhere.

If you doubt us, just look at the role of mobile (payments) in Africa, digital platforms in China (where payment integration is critical to success), and India’s UPI payments infrastructure that have transformed local economies not to mention global perceptions.

In these narrowing, protectionist times it’s also heartening to see that fintech is enabling a more even world – nearly half the world’s leading financial centres have been displaced by fintech ecosystems in emerging regions.

Given payments outsize role in driving digital transformation we’ve thought a little perspective might be helpful – so here’s our top 10 payment trends as we enter the 2020’s….

1 – Forget trade wars, tariffs and Trump – payments are globalising.

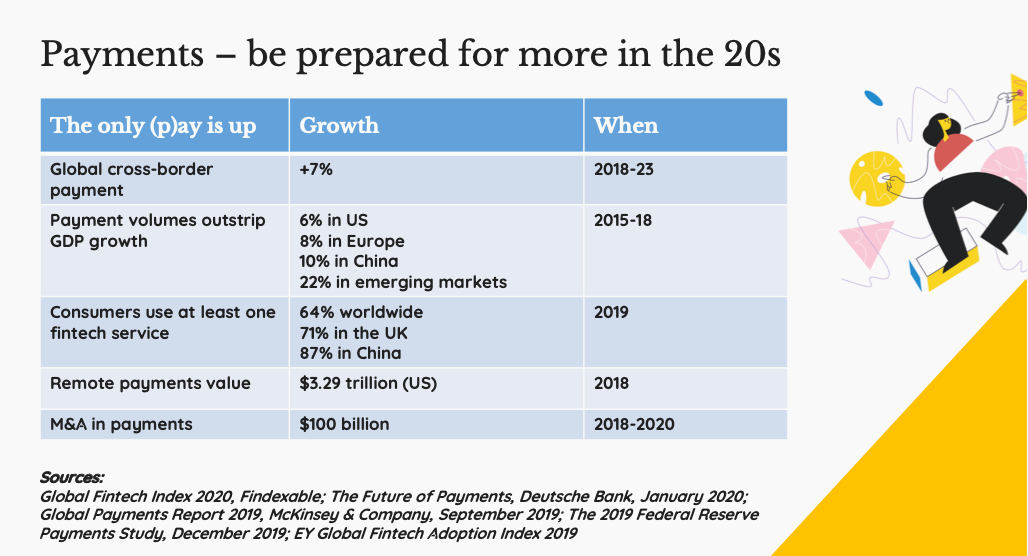

The ‘digital economy’, ‘the fintech revolution’, ‘the payments transition’; pick your moniker – but whatever lens you look through payments are globalising. And the centres of financial gravity might not be who you think they are – nearly half of the world’s 20 most important financial centres drop outside the top 20 fintech hubs. What’s more, cross-border volumes driven by e-commerce growth represent among the biggest opportunities for incumbents and innovators with estimated growth of 7% to 2023. Across developing regions expect annual growth in payments volumes to top 14% and large Asian markets like India and Indonesia to grow faster than China at 9% a year.

2 – The only pay is up!

Payment option proliferation driven by customer need and a long tail ability to tailor payments for specific purposes has ended the one-size-fits-all payment model of merchant-issuer-acquirer. This might sound scary for card networks and incumbents but there’s more than enough room for everyone. Payments is one of the few areas everyone in financial services can agree on – the only way is North. Across developing and mature markets payment volumes continue to grow – outstripping GDP growth in all regions: at double the rate of GDP growth (by 8%) in Europe, 22% across emerging countries, 10% in China and 6% in the US.

3 – Trust is earned. Not entitled.

Banks can no longer rely on customer trust as a defensive strategy. Explosion in use of new payment platforms and fintech applications, and the rise of autonomous app payments from delivery and transportation services like Uber prove that trust is more fluid. Approaching 64% of global consumers have used at least one fintech service rising to 71% in the UK and 87% in China. Globally three quarters of customers have used a payments or money transfer fintech service. New platforms night need to work hard to prove they deserve it, but trust is no guarantor of banks’ future either.

4 – e-Commerce is ‘ere to stay.

E-commerce will continue to crack the store windows of high street retail – the largest single contributor to the gradual demise of cards as e-commerce payments by smartphone replace the PC. For the first time in 2018 the value of US remote card payments closely equalled the value in-person payments (at $3.29 trillion). E-commerce payments also present the biggest opportunity for cross-border transaction (and income) growth. With new platforms and emerging technologies from voice to in-car payments and wearables – e-commerce growth will remain hot for a while to come.

5 – East is best.

The Asia Pacific region continues to dominate payments from all angles – volume growth, revenue and profit over the last five years have beaten other markets hands-down. Growth for the next five years might be less frothy but with large markets like China and India continuing to push hard to building a holistic digital payments ecosystem the region will be hard to beat. Don’t be dazzled by the numbers though. Anyone looking to enter the market will need to do their homework. For example, China might be the single largest contributor to payment industry revenues – but a tightly controlled market and high competitive barriers restrict the opportunity largely to locally based banks.

6 – Cash – once king, now courtier

No payments list is complete without some reference to that reliable payment staple – the humble banknote. While there’s no doubt the world is moving away from cash it’s certainly not game over yet. In fact, fears of trade wars, more protectionism from things like, yes you guessed it Brexit… and threat of conflict in the Middle East have caused a counter-intuitive retreat to the familiar arms of cash by investors. A recent survey put cash as the second favourite payment method among consumers across 6 countries including the US, UK, Germany and China. Cash is now less king – more trusted courtier. Expect cash to continue to be a feature of our economies for (at least) the next decade.

7 – Couldn’t card-less?

The same cannot be said for cards. While card payments have held up well and continued to grow at a healthy pace in mature markets – the dynamics of digital and rapid growth in smartphone use for in-store and e-commerce – anticipated at up to 40% of in-store payments in the US within 5 years, (particularly in emerging markets with little card issuance infrastructure) are likely to mark a turning point for global card issuance and use. Expect businesses of all sizes to be incentivised to drive the digital payment transition – the data rewards and incremental spend enabled when customers get comfortable with a new payment method will be powerful forces.

8 – M&A: Re-shuffling the decks

M&A in payments topped $100 billion in the two years since 2018. And ongoing disaggregation across the payment value chain will keep up competitive pressures and keep the M&A engine running – at least in the short-term while money is cheap. Regulatory moves to open access to customer data through open APIs – already in place in Europe and coming to the US in 2020 – the ability of large merchants to process payments profitably at scale, the success of e-commerce platforms like Amazon and Alibaba to create large pools of payments are just part of a cycle that is breaking the chains between businesses, merchants and incumbent banks – putting very heavy pressure on margins in the process. Buy-out or sell-out will be the only option for some businesses struggling to keep up with the pace of change.

9 – Cloud 9..10,11…

If the concept of trust in banking is changing, so are perceptions of the safety and stability of financial services hosted on the cloud. The new dynamics of digital – continuous improvement, rapid deployment, and agile response – mean that concepts like product manufacturing and customer ownership are about as relevant today as the benches that Florentine traders used to break when they could no longer lend money. Expect more use of cloud-based platforms to deliver and develop new services, at speed – with the potential for more collaboration between fintech innovators and incumbent institutions – and yet more pressure on margins as the drive for scale and data incentivises transaction discounting. For banks in particular the old argument of buy v build will continue to rage (but ‘buy’ should win out).

10 – Payments – your flexible friend

Flexibility has moved up a notch from the days when ‘flexibility’ referred to the material credit cards were made from. Making money from payments in the 20s requires a culture that prioritises the consumer – where flexibility is the primary attribute – and customer experience the force that drives ‘top of wallet’ behaviour. Importantly, despite many banks’ apparent resignation that they’ve lost the payments race – the game is far from over. Strong reputations for reliability and stability, correspondent networks that enable cross-border payments in corridors not supported by fintech attackers, and real-time technology that allows under-writing at point of sale, or makes it easier to offer instalment payments to meet consumer demand to match borrowing with specific spending, mean the field is wide open for enterprises with the flexible payment mindset.

Sources:

Global Fintech Index 2020, Findexable

The Future of Payments, Deutsche Bank, January 2020

Global Payments Report 2019, McKinsey & Company, September 2019

The 2019 Federal Reserve Payments Study, December 2019

EY Global Fintech Adoption Index 2019

The Global Fintech Index 2020 City Rankings is now live! http://bit.ly/2020GFI

Follow us on @findexable