Readying for Impact – Fintech in Latin America post Covid

Over 1300 fintech firms, 3 fintech hubs among the world’s 40 leading ecosystems globally, and some of the world’s highest rates of fintech adoption Latin America’s fintech scene has boomed over the last 3 years – but what impact will Covid-19 have on its future?

The world keeps spinning and at Findexable it definitely hasn’t stopped these last few weeks. We’re getting stories and updates from our network of partners across the world about the challenges they’re facing and the strategies they’re deploying to face up to them.

In addition to our webinars on merchant payments in Africa, views on shifting patterns of globalisation and our Advisor and CFO’s perspective on the hard decisions to take now to weather the storm we’re turning to Latin America where our regional Ambassador sends us his report on how fintech is responding to the corona-crisis.

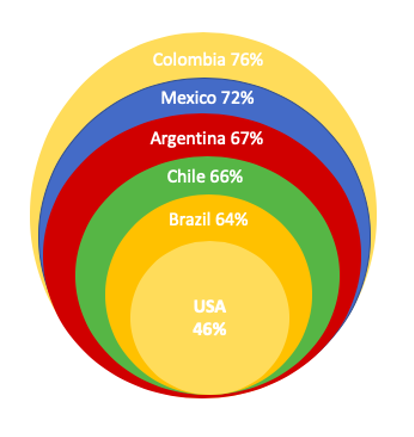

Flag 1: Flag carriers: Fintech adoption in Latin America – EY Global Fintech Adoption Index 2019

How is coronavirus affecting Latam fintech?

It’s still early but with the region anticipating the potential for the largest recession in 50 years – our expectation is for a broad range of direct and indirect impacts similar to other regional start-up sectors:

- Weaker business conditions leading to lower demand – affecting fintech operating performance

- Funding conditions and regional growth may weaken leading to longer runways and higher cash needs

- More limited exit options and the end of an era of cheap capital?

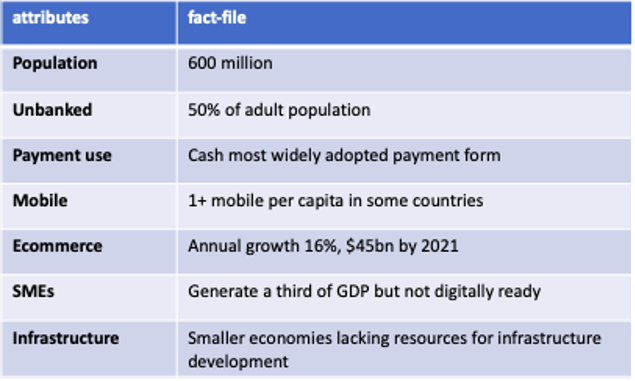

Flag 2: Big and growing: Latin America fact-file

These broader impacts are likely to play out in different ways across individual fintech segments:

Challenger Banks. No more growth at any cost: Reduced business activity against higher demand for digital interactions as customers have restricted mobility and can’t access bank branches will lead to an urgent need to monetise customer acquisition costs.

Online Lending. The first litmus test for new risk models: Lower net interest margins = less volume. With default rates rising, the impact will be felt more severely by lenders focusing on SME customers. Data innovations and algorithmic underwriting of loans will be tested in the open for the first time.

Payments & transactions: Dampening but not dying: Decrease in financial activity against growth in non-financial services.

Institutional capital markets. Growing, growing. Gone: Top-line growth at all cost” is gone, no more cheap VC capital to drive customer growth. Are risk and cash the new kings?

InsurTechs. An idea whose timing is coming? Expect a demand boost for life, health, and business disruption coverage.

Flag 3: Viva fintech! Latin America fintech by numbers

Fintech after Covid?

As the next 6 months unfold there will be a tug-of-war between the two ends of the fintech equation – the strengths of the sector’s digital heritage v the realities of smaller companies battling in a weak economy.

A regional and global ‘bump to digital’ will accelerate some opportunities while a flight to security may tempt some customers back to their banks. Whatever the outcome, fintech’s innate strengths pair well with the shifts in consumer and business behaviour we’re likely to see last well beyond the outbreak:

- Digital by design – shifting to remote work environments

- Fintech makes self-isolation possible (even livable)

- Regional ramping up of tech capabilities and digital adoption

- Lack of credit and liquidity from traditional sources feeds fintech market potential

Latin America’s progress in developing thriving fintech ecosystems won’t disappear but it will be severely tested in the months ahead.

Stay informed. For more information and insight – join our global briefings series over the next few weeks as we talk to fintech founders, ecosystem partners and institutions on the impact of coronavirus, and what comes next. www.findexable.com. Download the The Global Fintech Index 2020 City Rankings on http://bit.ly/2020GFI