New York maintains its position as one of the top cities in the world for fintech

- Proximity to the heart of international banking means that there is a strong fintech presence in the city

- Start-up accelerators sponsored by major banks are a key factor driving growth

- Other cities have thriving fintech scenes, with many US cities joining the index for the first time or rising up the ranks

- The 2021 findexable Global Fintech Rankings is produced in partnership with Mambu, the market-leading cloud banking platform

London, UK – 23 June 2021: The city of New York has retained its place as the third best city in the world for fintech companies, behind the San Francisco Bay Area and London, according to findexable’s algorithmically determined Global Fintech Rankings report. This comes as fintech itself is booming: Mastercard data shows that in the first quarter of 2020, there was a larger shift to digital payments in 10 weeks than they had seen in the preceding five years.

The 2021 Global Fintech Rankings, powered by Mambu, identifies emerging hubs, fintech companies and trends. The Index algorithm ranks the fintech ecosystems of more than 264 cities across 83 countries incorporating data from findexable’s own records and collated and verified by its Global Partnership Network, including Crunchbase, StartupBlink, SEMrush and 60+ fintech associations globally. The index was first published in 2019 and has seen a huge uptake by the fintech industry.

Unsurprisingly, the United States led the world in total number of fintech companies, as well as their algorithmically-determined ‘quality’ score, but a little under half of all fintech companies registered in the report were concentrated in the Bay Area and New York – 810 total for these two cities versus 876 in the rest of the country.

New York is one of the world’s great financial centres, so it is no surprise that a city that hosts the headquarters of some of the largest banking and investment companies would also be home to a thriving fintech scene.

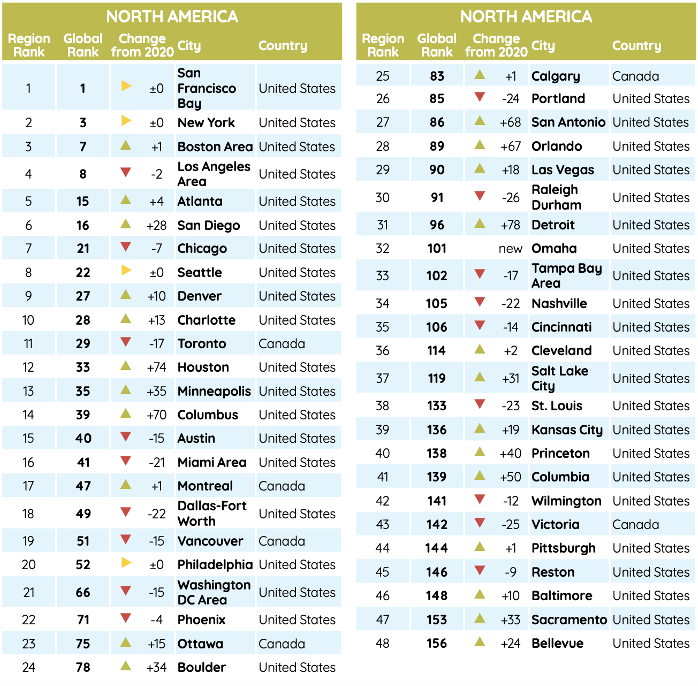

Although two regions are pre-eminent when it comes to fintech, the rest of the country has shown strong growth, with many cities reaching the inclusion criteria (10 or more fintechs in the city) for the first time this year. This was part of a global trend that saw fintech moving away from a small number of established financial centres such as San Francisco, London and Hong Kong and towards a much more dispersed fintech environment. In the US alone the report shows Omaha, Burlington, Albuquerque and Lewes entering the index, as well as significant climbs from Detroit, Houston, Columbus, San Antonio, Orlando, Columbia and Princeton bringing investment and jobs for the local economies.

This growth in previously underserved areas echoed a theme seen across the world. The report showed huge growth in the number of countries and cities being listed: more than 50 new cities and 20 new countries joined the index for being home to at least ten fintech companies. The report found that even during a year of significant economic downturn and serious disruption, fintech companies were being launched and significant investment was being made in the sector, more than doubling the value of fintech unicorns as a group from $199 billion to $440 billion.

This speaks to one of the report’s larger themes, which is that fintech is bridging gaps in consumers’ lives, many of them revealed or made more urgent by the COVID-19 pandemic. Data from Mastercard showed that in the first quarter of 2020 there was a greater shift to digital banking in ten weeks than there had been in the previous five years. Fintech can no longer be dismissed as a fad but is a part of billions of people’s lives – ‘fintech for all rather than the few’. However, there is a significant gap between major players and the next generation of innovators in terms of funding that needs to be addressed to keep the industry moving forward with new ideas. There also remains a gap between the customers of fintechs – women are often early adopters, while emerging markets are sources of giant user bases – and the people leading them.

Findexable’s founder and CEO, Simon Hardie, explains: “Although San Francisco has Silicon Valley, New York has Wall Street, and we have seen that the proximity to the heart of global finance has strong network effects which allow fintech companies to flourish.”

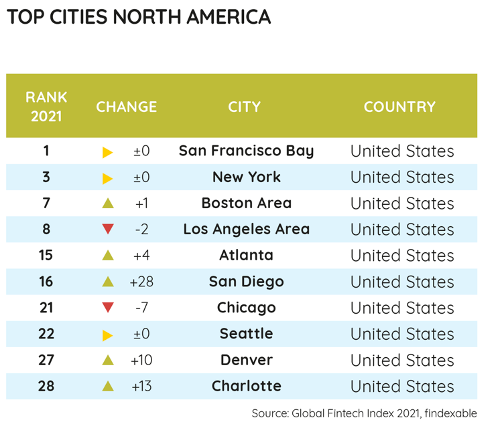

He adds: “I would also like to highlight the explosive growth of other US cities. San Diego surged up the rankings to 16th place and Houston jumped 74 spots to 33rd. The top 40 cities in the world for fintech are dominated by US cities, including Boston, Los Angeles and Atlanta, though with the amount of movement from other areas of the world this may not continue for long.”

Elliott Limb, Mambu’s Chief Customer Officer, comments: “Fintechs are part of a global revolution to make financial services easier, faster and simpler. They are changing the way we save, spend, borrow, and invest money. Whether competing, cooperating or supporting traditional financial institutions, they are reshaping digital services for a real-time, on-demand world. It makes perfect sense for New York to be a thriving hub for fintech innovation.”

He adds: “There is a huge opportunity – today and for the future – to help companies of all types make access to financial services seamless. This in turn talks to a key theme of this report – bridging the gap. We’ve seen this gap – in understanding of services to product offerings and ability to deliver. We operate in a market that allows for and celebrates change and innovation. Mapping this is a mammoth task. We are proud to support findexable, their research and the results that shed light on the future of financial technology.”

For the purpose of the Indexalgorithm, fintech is any business that applies a technologically enabled innovation specifically geared for the provision or distribution of financial services.

The country and city rankings were calculated from a total score comprised of a combination of three metrics:

- Quantity – Size of fintech ecosystem and supporting structures – number of fintechs, fintech hubs, co-working spaces, accelerators, global influencers and population (countries only)

- Quality – Impact/performance – size and growth of fintechs (e.g. number of unicorns), investment, events, value generation, international collaboration, website ranking

- Environment – ease of doing business, critical mass, regulatory environment – regulatory interventions to improve competitive environment, incentives for start-ups, internet censorship, payment portals, fintech courses.

To learn more and download a copy of the report, visit: https://findexable.com/2021-fintech-rankings/