Early Warning Systems – It’s never too early

2000, 2008 and now 2020. Two might be forgiven for being an accident, three looks like carelessness. When the dust finally does settle on the pandemic and the recession that follows, louder critics will remark how badly prepared many countries, and businesses, were for the outbreak and its impact on the economy.

With the crisis continuing to play out, and the depth of its impact still uncertain, it’s too early to predict what we’ll learn or what will change when the recovery comes. Whatever the merits or mistakes of individual countries or regions in their response, two factors stand out as being critical to global preparedness for future events and to minimise the risk to the economy and the financial welfare of citizens everywhere:

- Mandate data collection to improve readiness for potential system or industry threats

- Upgrade (digitise) the tools and instruments that manage the global economy

What do we mean by this? From every direction – jobs to taxation and the manufacturing that enables global consumption – it’s starting to look like the twentieth century model of globalisation, and the mechanisms for managing it, have passed their sell-by date.

Take three, now widely-understood statistics, making the rounds the last few weeks:

- The average US worker under 44 has less than $4,000 dollars in savings[1]

- The average small service business in the US has just 19 days ‘cash-in-hand’[2]

- ‘Just in time’ supply chain models have caused global ‘shortages’

Given that consumers drive our primarily service-industry economy, the majority themselves employed by small and mid-size businesses (that make anywhere up to 98% of a country’s private sector), and that production supply chains for household items circle the globe, the precarious nature of modern work and the growing numbers of small or start-up firms, are unfit to cope with any crisis, much less one on this scale.

Out of sight, out of mind

A large part of the problem lies with our interpretation of economic events and business performance which relies on past data as a guide to the future. In a digital economy where transactions are made, orders are processed and goods dispatched in milliseconds, this may not be enough.

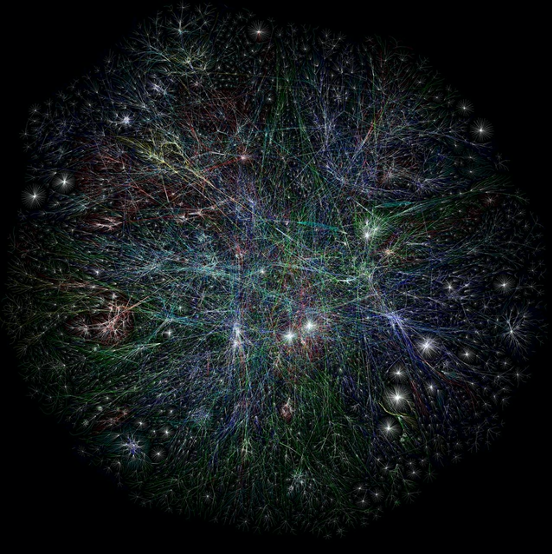

Similarly, our conception of the way business works is linear, welded to the concept of the twentieth-century production line. Goods are manufactured, orders come in, invoices are sent and then get paid. Online, all these events can, and do, happen almost simultaneously. As the digital economy infects the physical world and vice versa, a linear model is no match for the neural network that the Internet and the global economy have become (Flag 1).

Flag 1. The 21st century production line

Partial map of the internet c.2005[3]

Why does this matter? Firstly, as the pandemic has taught us, an unexpected event in one part of the system can very quickly spread and infect the rest of it. We might not be able to stop transmission of a disease in time – but we could make sure we have the systems in place to take a coordinated response to contain its impact.

Secondly, a system-wide, real-time view instead of a linear one, would help us see that events like these may be a natural characteristic, not a freak occurrence, of our networked world. Without the visibility or the mechanisms to manage our response, we are destined to repeat the same mistakes when the next bug comes out of hiding.

Life. Or something like it.

We already have the tools and the technology to make this possible. In 2005, just 8 million UK households had a broadband connection. Today 96% of them have. Large parts of the world have been shuttered by the pandemic but the digital economy we have already means life, our work and our businesses though interrupted, can carry on.

Growth in the digital economy over the last 15 years has led to a massive increase in data and connectivity between individuals, industries and institutions. Over the next decade parallel growth in computing power will help us make better predictions from the data we have available.

It’s not just about the technology, rules matter too. In Europe financial regulation like the UK Open Banking and European Union’s payments regulation, as well as the digitisation of national company registries and statistical agencies, already make it easier for governments or entrepreneurs to mine large datasets related to company performance or personal finances.

Bend the rules. Please.

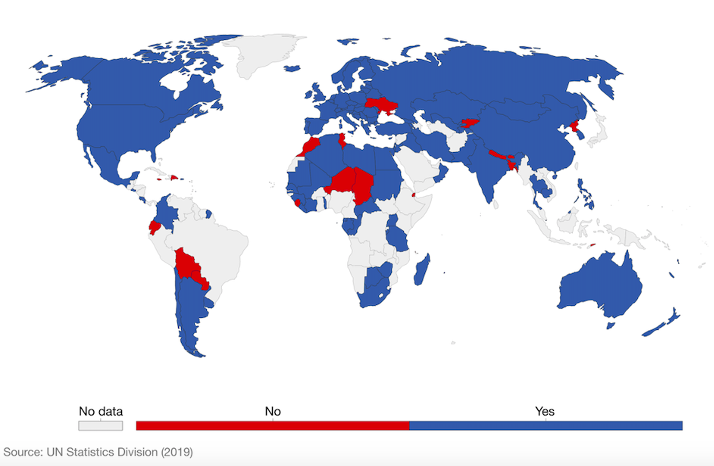

Under the Sustainable Development goals, global commitment to improving macroeconomic stability through better data sharing and national statistical legislation, means much of the rest of the world – both developing and rich countries – has also made progress in putting the rules in place to collect statistical data (Flag 2).

Flag 2. Feeling blue

Does your country have national statistical legislation? (2018)[4]

Would it be too much to ask that the rules be re-purposed or improved to enable the creation of early warning systems – to highlight potential impacts of system events or the risks to particular segments of the economy, so government and businesses can take the steps to prepare?

The academic literature says early warning systems that accurately predict the risk of default, or business failure, are possible. Since the year 2000 close to 100 academic studies have been published focusing on the development of early warning systems to mitigate the risks of future economic and financial crises[5].

Collective action to build an early warning model – for businesses to determine what steps they need to take, for governments to understand how many citizens or livelihoods are at risk – would put us in better shape next time round.

After coronavirus, if nothing else, we must learn to use the

power the digital economy is putting in our hands. A better world starts with a

more predictable one.

Stay informed.

For more information and insight – join our global briefings series over the next few weeks as we talk to fintech founders, ecosystem partners and institutions on the impact of coronavirus, and what comes next. www.findexable.com. Download the The Global Fintech Index 2020 City Rankings on http://bit.ly/2020GFI

[1]How much money Americans have in savings, CNBC https://www.cnbc.com/2019/03/11/how-much-money-americans-have-in-their-savings-accounts-at-every-age.html

[2] Small businesses could vanish during the coronavirus pandemic, The Street https://www.thestreet.com/personal-finance/pandemic-recession-impact-small-businesses

[3] Map of the Internet, Opte.org 2005 https://en.wikipedia.org/wiki/File:Internet_map_1024.jpg

[4] Sustainable Development Goals Tracker, Our World in Data, 2019 https://sdg-tracker.org/global-partnerships#targets

[5] Early warning system in business, finance, and economics: Bibliometric and topic analysis, International Journal of Engineering Business Management, Igor Klopotan, Jovana Zoroja, and Maja Mesko