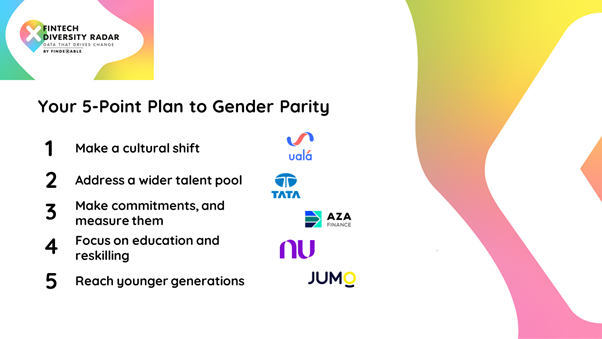

Creating purposeful change: moving beyond talking for gender parity

Purposeful change for diversity – at an individual, organisational, and societal level – is a necessity to correct the disparate impact of COVID-19 on women. Without drastic intervention, there is a very real risk that any existing diversity and inclusion (D&I) progress could reverse, at a detriment to gender equality and the global economy. As organisations reckon with the new normal and rethink how to do business in the post-pandemic world, they must use this opportune moment to look more intentionally at gender equity.

At findexable, we are building the Fintech Diversity Radar, the world’s first global platform gathering progressive data on women in fintech to understand their impact and contribution to the digital economy. As part of our upcoming launch in November, we have conducted a series of in-depth interviews with fintechs and financial service providers from around the world to hear first-hand how they are proactively tackling gender diversity. In this article, we give an exclusive preview from leaders at Tata, Nubank, Ualá, JUMO and AZA Finance, to find out how they are achieving purposeful change within their own businesses.

1. Make a cultural shift

Making a tangible cultural shift is a complex task that requires bold and affirmative action to regain ground lost in the last 18 months. Several of our interviewees have pointed out that in order to change diversity within a company, they must proactively address the diversity issues in wider society. Diego Solveira, Head of People at Ualá, agrees. Ualá is a personal financial management mobile app developed in Argentina, where 48% of the organisation are women. Solveira commented: “If you don’t change society, if you don’t change the market, if you don’t build capacity that anybody can use, you will never get gender inclusion.”

However, impacting wider society is a significant ask for even the best-intentioned companies. Preeti D’mello is Global Head of Diversity and Lead Academy at Tata Consultancy Services, an Indian multinational information technology services and consulting company headquartered in Mumbai. D’mello echoed Solveria’s thoughts but noted that making change is difficult when there is no standard understanding of diversity. “It just varies from culture to culture, country to country,” she explains. “I think every organisation is trying to set its own norms and principles.”

For companies struggling with ingrained societal bias, there are ways to make changes that can help redress the balance; for example, expanding their own policies beyond those set by the government. Solveira describes how in Argentina, the government gives three months leave of absence for women when they give birth, but just five days for the male parent. “If you don’t change that, you’re pushing women to stay home, to raise the kids. So, we extend the licence for both so that they can work together on parenthood.”

2. Address a wider talent pool

Our interviewees made it clear that expanding recruitment to a broader talent pool is paramount to changing the ratio of women at organisations. Many recruitment leaders consistently look in the same places, and typically focus their diversity hiring efforts on women in entry-level roles rather than mid-career or senior positions. As a result, we see many women in graduate schemes, but very few at board level; indeed, according to early data from our Fintech Diversity Radar, only one in four C-Suite roles, and just 12% of board seats, are held by women globally in fintech right now. However, tangible change can be made by thinking laterally about hiring, including where organisations advertise roles and how they word their job adverts.

One anonymous interviewee describes her own experience of successfully increasing gender parity in the recruitment pool at a tier one bank in the UK. “I was given the task of reinvigorating the diversity in the market’s talent pipeline, which we were struggling to get,” she explains. “In 12 weeks I managed to get us to 50% parity on men and women by just thinking a little bit more laterally.” This included reaching out to women in middle office roles. “They’re stuck in the middle office and always wanted to be a trader,” she continued, “but they can’t get into it because the door of opportunity is so narrow. So, we invited them to come here and take a trading role as a junior.”

Another way of increasing gender diversity in mid-career roles is by offering returnships: professional internships designed specifically for people returning after an extended career break. Some women may choose to make changes to their career path and, with their previous experience in another role or sector, bring with them years of skills that could strengthen the fintech industry. Our interviewee used a popular internet forum for mothers as an example. “If you want to get more female returners, go look at Mumsnet,” she suggested. “I’m sure there are plenty of really clever people in there that would welcome an opportunity to revisit previous career paths that have been put on hold for any number of years.”

3. Make commitments, and measure them

The management adage “What gets measured, gets done” is particularly relevant for D&I. But while committing to diversity goals in recruitment is a step forward, there is a distinct difference between positive discrimination and positive action. Positive action comes into play when a business is deciding who to hire or promote between top candidates who are equally qualified. In this instance, an employer can choose to hire an individual from an underrepresented group if they are as qualified and fit for the role as the other applicants.

Premo Ojokojo,Global Head of HR, AZA Finance, explains positive action in practice. Founded in Nairobi, Kenya, in 2013, AZA Finance has grown from a currency exchange platform to a global financial services firm focused on frontier markets and currencies. Ojokojo commented: “The first thing we look out for is the right talent. And then the next thing we look out for is talent in the gender that we want.” This method has been incredibly successful. “Right now, in our Nigerian location, we have 80% female and 20% males,” Ojokojo explains. “We’re doing our best to grow the global agenda for the company, which includes increasing the number of females in the organization in certain key roles.”

Deborah Abi-Saber, Global Head of Diversity and Inclusion and People Support at Nubank, is a big believer in measuring not only gender ratios, but also measuring inclusion. Nubank is a Latin American neobank and the largest financial technology bank in Latin America. “We have engaged in surveys that help us to try to measure [inclusion],” she explains, “And so we run it twice a year. I love to work with data, I think it is super important. Sometimes HR or some D&I areas forget how important it is. But when you present to the business, you must have a strong case. And if you don’t have data, it will be much harder for them to hear.”

4. Focus on education and reskilling

According to a recent UK study, women are the largest untapped pool of talent when it comes to accessing talented recruits. Apprenticeship programmes create new career paths to re-skill people whose jobs will be disrupted by technology or for non-traditional hires. Ojokojo believes this is critical in the African fintech market. “Our focus is mostly on finding more and more ladies who want to be engineers and are scared to do it,” she describes. “So, apart from teaching them how to be one, it is also to give them leadership and other management skills that will put them above the rest.”

Organisations can also create mentoring schemes for women and other protected groups. According to McKinsey research, when reflecting on their careers, senior-level women of colour in financial services are much more likely to cite a manager or leader as critical to achieving their promotion. Abi-Saber comments that they launched their first successful mentoring programme for women at Nubank earlier this year. “It was a pilot, and the results seem to be very good… the idea is that we can create a bigger internal view of the pipeline of women to senior positions.”

Solveira has also seen great success with such programmes at Uala. “We started a programme that we call the Data Academy. We focused our training budget into training women – men were already trained – and we were able to find them in the market.” Uala saw the tangible impact that this had on creating mentors and has run the initiative several times now. “The first girls that came out of those programmes are actually the “godmothers” of the ones that came afterwards,” he explained.

5. Reach younger generations

Current estimates suggest that gender equality is likely to take 108 years to achieve unless we change our approach, and this starts with the next generation. A 2019 study in the UK showed that twice as many boys as girls have had a career in technology suggested to them, that twice as many boys cite STEM as their best subject, and 70% of jobs at risk of automation are performed by women. The situation feels difficult to overcome, but organisations across all global markets are making great strides to provide invaluable resources, guidance and advocacy to encourage girls to pursue careers in STEM.

Many of the fintechs we spoke to are looking to expand their talent programmes to the next generation. Solveira describes how, at Ualá, inspiring girls to take up a career in technology is a key part of their D&I initiatives. “We cannot reach gender inclusion if you don’t start from girls that haven’t gone through training yet,” he explains. “If you’re serious about gender inclusion, you need to grow the market, you need to push and help girls to get into IT careers or coding courses.”

Jade Potgieter, ESG Lead at South African fintech JUMO, describes how they partner with other academies to encourage younger women to take up a career in tech. “We, from a corporate social investment perspective, partner with a coding academy called Girl Code,” she explains. “We also work with another coding academy, specifically in Cape Town called Life Choices. They don’t have a lot of female candidates in their learner’s profile at all, but they do have a lot of previously disadvantaged groups which come through.”

Climate change and the pandemic are undeniably exacerbating gender inequalities, and disproportionately affecting women and girls in all countries. However, despite the challenges, our interviews show that change is possible when fintechs act with purpose.

At findexable, our mission is to help provide a transparent global benchmark for diversity in fintech to create a more equitable future. If this sounds like something you would like to be involved in, then take the Fintech Diversity Radar survey here.