Corona impacts – How is Covid-19 impacting the payments industry?

Companies and individuals all over the world are currently being affected by what’s likely to be the toughest trial most of us will ever experience. For us in the fintech sector, there’s certainly no exception.

Naughty, but needed

Particularly if you’re in the business of payments. What makes global payments interesting is that it’s a necessary evil for businesses, a given for consumers and is about as close as it’s possible for an industry to get to Adam Smith’s ‘invisible hand.’ We don’t want payments, we definitely need them – and yet, increasingly, we can’t see or touch them.

Understandably, companies generally don’t enjoy giving up a % of their hard-earned revenue to a company just so they can be paid the money that’s owed them, and to our knowledge there’s no payment equivalent of the trainspotter waking up to look forward to watching a ton of payments being made. Payments have simply evolved to accommodate evermore demanding consumers in a world where convenience is king – if I want to pay by card and you won’t let me, I’ll simply go next door or to another website.

Invisible, but very real

What people outside of the industry may not be aware of are how many mouths there are to feed on a small margin. In one transaction you may have a facilitator, a gateway, an acquirer, an issuing bank and a card network all having to take a cut of a few basis points. Furthermore, big-ticket items are high risk operations and if you manage to process payments for SMEs, transaction volumes are too small to justify a low transaction fee.

So what happens when the world sees a global economic downturn, businesses are shutting down and the payments ecosystem is disrupted?

Flag 1: Push and pull

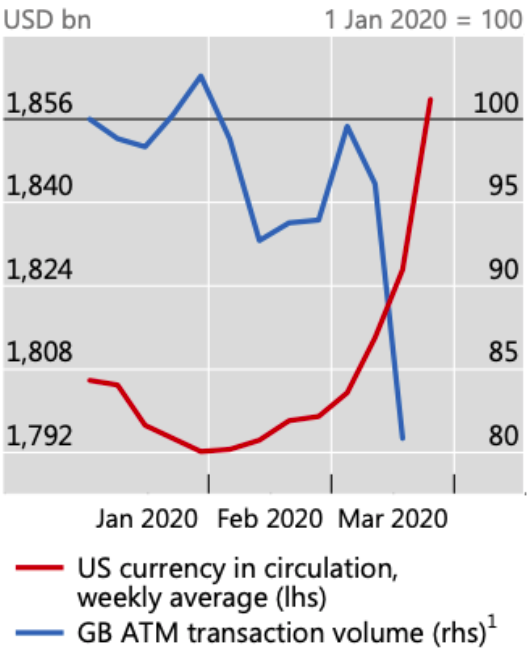

Coronavirus causing erratic changes in demand for cash – BIS Bulletin No3, Bank of International Settlements, April 2020.

The first natural way to look at it is the distinction between face-to-face payments and e-commerce. Over the next few months we should expect to see ISOs, PFs and payment providers specialising in retail, in-person payments take a significant hit.

Some are more equal than others

Not everyone is equal though. In the payments supply chain some companies will potentially be doing much better than others. For example, a company whose core business is providing card terminals to businesses will be using an acquirer, but the acquirer will probably also be providing e-commerce services to other companies.

If more shops close because of a prolonged lockdown, and we’re forced to stay inside our homes, or if the few shops that stay open run out of supplies we can expect another sharp spike in e-commerce transactions.

Because an e-commerce transaction is processed in industry lingo as a ‘Card Not Present’ transaction, and commands a higher transaction fee, then, depending on the number of transactions, acquirers may be making more money from your everyday shopping because now all of it is being done online.

Risky businesses

With the world in isolation, some high risk industries are thriving. Examples include certain entertainment industries and online gambling. These online industries in particular have a very high transaction rate due to the nature of their business and the level of chargebacks (when a consumer tells their bank to dispute a payment because it’s an unknown transaction and the bank “charges” the funds back) and are already seeing significant increases in visitor traffic.

Over the coming weeks, payment businesses that are hit hardest will be ‘front-end’ providers – such as those specialising in face-to-face payments or physical retail, where card issuing banks and card schemes will see a drop, although not big enough to be a cause of concern or systemic damage.

Are you a survivor?

And the survivors? The ones to get out of this on top will be the acquirers – particularly those specialising in high risk and e-commerce. There will almost certainly be a small number of acquirers who will benefit from the outbreak overall instead of seeing an overall drop in transaction volume.

After a decade of disruption in payments and across financial services, not to mention the continuous reshuffling and offloading of merchant acquirer divisions by card-issuing banks and processors the coronavirus is likely to unleash a new wave of consolidation and competition for business that can thrive in any economic weather.

We can almost expect to feel the impact of the coronavirus on the payment transaction industry long after the pandemic has passed.

Stay informed. For more information and insight – join our global briefings series over the next few weeks as we talk to fintech founders, ecosystem partners and institutions on the impact of coronavirus, and what comes next. www.findexable.com. Download the The Global Fintech Index 2020 City Rankings on http://bit.ly/2020GFI