OPEN FINANCE

The winds of change blow through open Banking

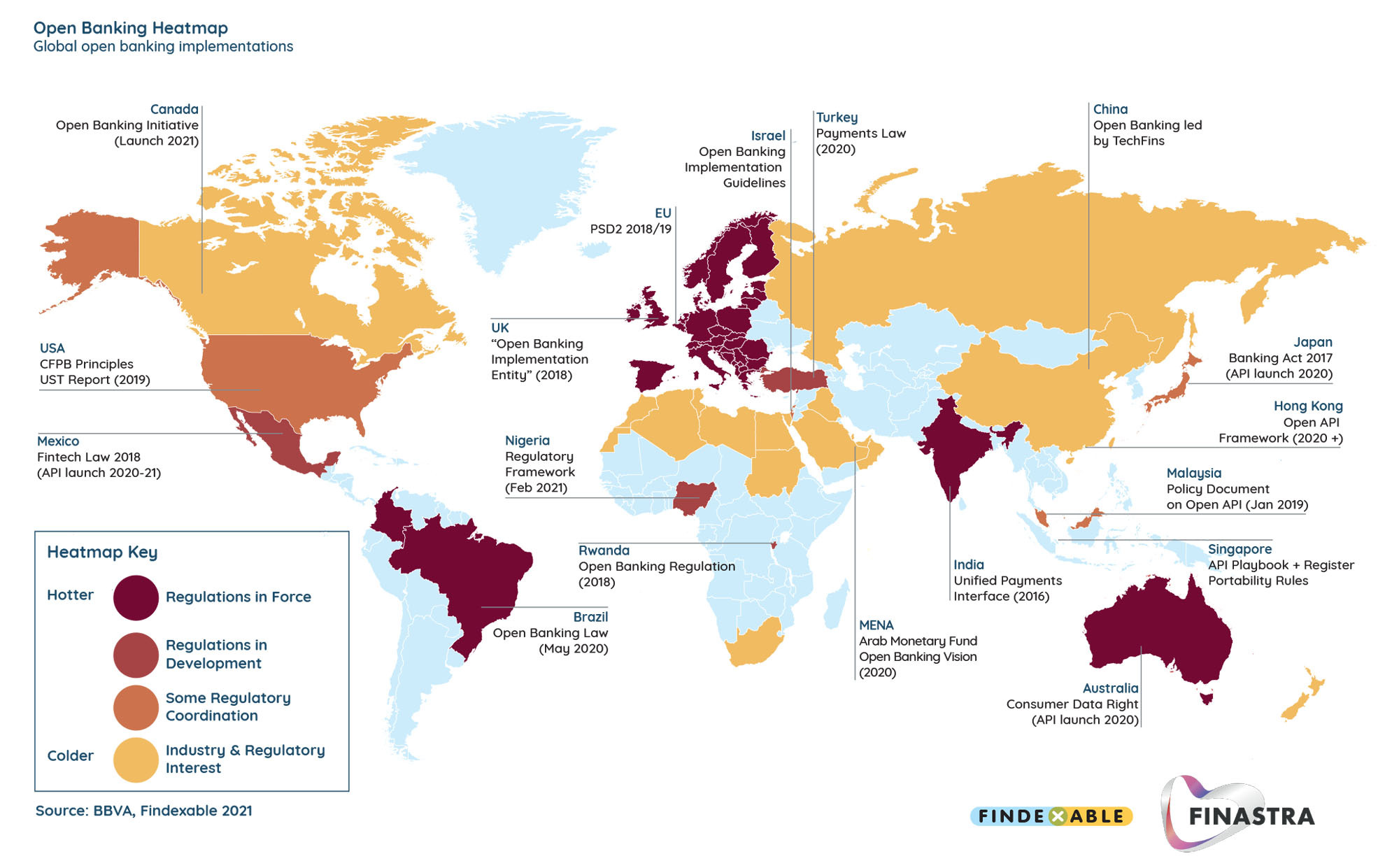

Open Banking either mandatory or market-driven, is creating opportunities and threats. Here’s a global look at regulations, industry led initiatives, and implementations around the world, showing the dynamic nature of open banking.

Author: Dr Efi Pylarinou

In this research short…

- Global open banking map & innovators

- Definitions and terminology

- Leading open banking jurisdictions

When it comes to open banking Europe holds the leading position in Fintech regulation with PSD2 being the most progressive and significant piece of regulation.

It is core to the Open Banking opportunity that is still under development and is the enabler for Embedded Finance and ‘As-a-Service’ offerings – from ‘Banking-As-A-Service’ to payments and a growing variety of fintech variations.

Defining open-ness

In Fintech lingo, Open Banking with a Capital ‘O’ is recognized as referring to regulations or any industry standards within countries, and open banking with a lower case ‘o’ refers to business cases or services that enable new business models using APIs to create value for the customer.

How is open finance developing and how can you use technology to accelerate change?

Register here for Finastra Universe – stream 100+ sessions on the future of open finance.

Open Banking and open banking are a duo that depend on each other in many ways. Jurisdictions that have been progressive in designing Open Banking regulation, have also attracted an entire ecosystem. Including developers and providers of APIs, Apps, and innovative services to serve the ‘consumers’ of these innovations.

Open Banking around the world

Europe

The UK has been the leader on the Open Banking front since forcing the country’s largest banks to open up to competition in 2018. Today, UK Open Banking a non-profit organization reports over 300 companies active in the open Banking market and more than 450 companies in the pipeline. The Open Banking Implementation Entity (OBIE) under the supervision of the Competition and Markets Authority has been instrumental to this thriving ecosystem.

In the European Union Open Banking Europe provides Europe with a collaborative environment for market players to identify problems and solve them via standards and tools. Luxembourg, Germany, and Italy are more advanced compared to other European countries in terms of Open Banking. The Berlin Group is a Pan-European entity that focused on developing technical standards around PSD2 and open banking practices. Switzerland however has no Open Banking regulation and is not obliged to follow PSD2 guidelines.

Members: 26 major members from the payment sector from 10+ European countries.

Africa

The Central Bank of Nigeria has just announced the Regulatory Framework for Open Banking. South Africa has no such Regulation.

MENA & Turkey

The MENA region is still in the working group phase with the Arab Monetary Fund (AMF) and the MENA Fintech Association (MFTA) publishing in late 2020 a report on the “Open Banking Vision from the Arab World.”

Israel

Bank of Israel published guidelines for open banking implementation in December 2019 but implementation has been slow so far.

Turkey

Turkey currently has no Open Banking regulation – but has passed payment law that in the spirit of open banking.

Asia Pacific

Open Banking regulation with its rich variety of flavors has clearly crowned certain jurisdictions as leaders in this respect. However, in several other jurisdictions market forces and innovations have been leading without the supporting regulation.

China

China’s successful TechFins, including Ant Group, WeBank, as well as Singapore’s Grab are examples of open banking with no regulatory framework. In fact it’s the reverse – the regulatory framework is following the market as can be inferred with the case of the cancellation of ANT’s IPO and subsequent regulatory clampdown.

India

Similar to Turkey above – no Open Banking regulation but implemented payment regulation in the spirit of open banking.

Singapore

An early adopter on the Open Banking front and remains the regional leader. The Monetary Authority of Singapore (MAS) and the Association of Banks in Singapore (ABS) have jointly produced the Finance-As-A-Service API Playbook to provide an open banking framework and guidelines. In 2018, Singapore launched APIX, an open architecture API marketplace and sandbox platform.

Members: Close to 400 fintech companies on APIX and 70 financial institutions.

Australia

An early follower of the FCA`s moves in the UK and an example of how Open Banking differs considerably by jurisdiction not only in terms of the style of intervention, but also the scope. Australia has included Open Banking regulation in their Consumer Data Law (CDR) which is not the case in Europe. For now, CDR only applies to banks but this may change to include other sectors such telcos and big tech firms.

Japan

Japan was early also in promoting Open Banking with an amendment of its Banking Act in mid 2018, however, actual adoption has been slow as it is not mandatory.

North America

Canada

In Canada there is no regulation and the Open Banking Initiative is just getting started on developing technical standards around open banking practices.

USA

In the US there is no consensus as to whether there should a regulatory-led approach like in the UK. The numerous regulatory bodies in the US complicate matters. For now, the Financial Data Exchange (FDX) is similar to the Berlin Group and the Canadian Open Banking initiatives. FDX is focused on secure API standards for financial data and has experienced explosive growth over the past couple of months with 33 new members bringing the total membership to 168 organizations[1].

At Finastra, we are OPEN by default. With FusionFabric.cloud, our open development platform powered by APIs and data, we are championing innovation through collaboration: we offer a unique opportunity for financial institutions and the global fintech ecosystem to foster open banking, work together securely, innovate faster and dramatically improve customer experience and operational efficiency as a result.

Christophe Langlois, Global Fintech & Developer Ecosystem Marketing Lead, Finastra

Flag 1: Open for business?

Banks putting open banking into practice

Open banking use cases from the regulated banking world of incumbents include BBVA, DBS Bank, ICICI Bank, and OCBC bank.

Source: Findexable 2021

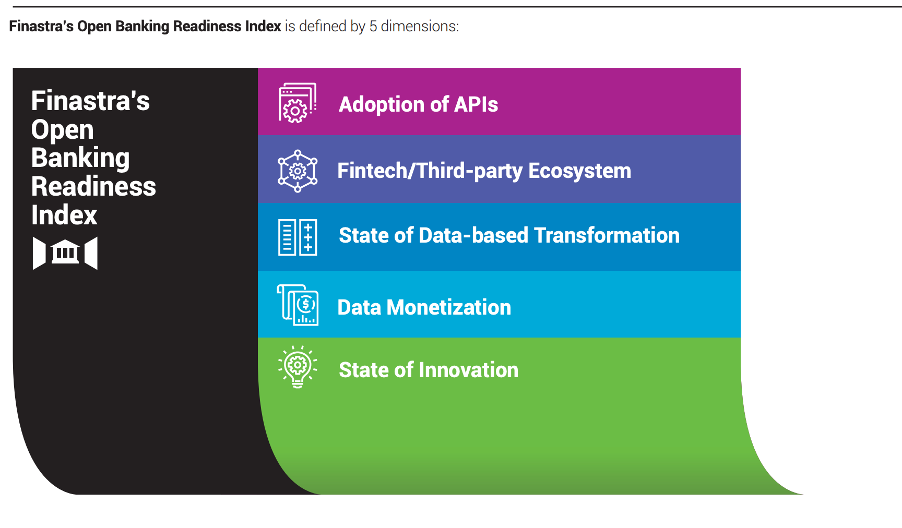

Flag 2: Gauging market maturity

How do you compare open banking markets?

There are multiple dimensions on which open banking maturity can be measured. A 2018 IDC financial insights survey focused on the Asia Pacific region and its Open Banking maturity, using the Finastra’s Open Banking Readiness Index to rank banks.

Today, open banking continues to be market-led while Open Banking regulations continue to be designed in different flavors around the world. In a recent global banking survey, up to 92% of banks are looking to leverage open APIs[2]. Below is a look at some of the leading examples in the space.

Register here for Finastra Universe – and hear from over 100 sessions on how finance is opening up and how you can accelerate through change.

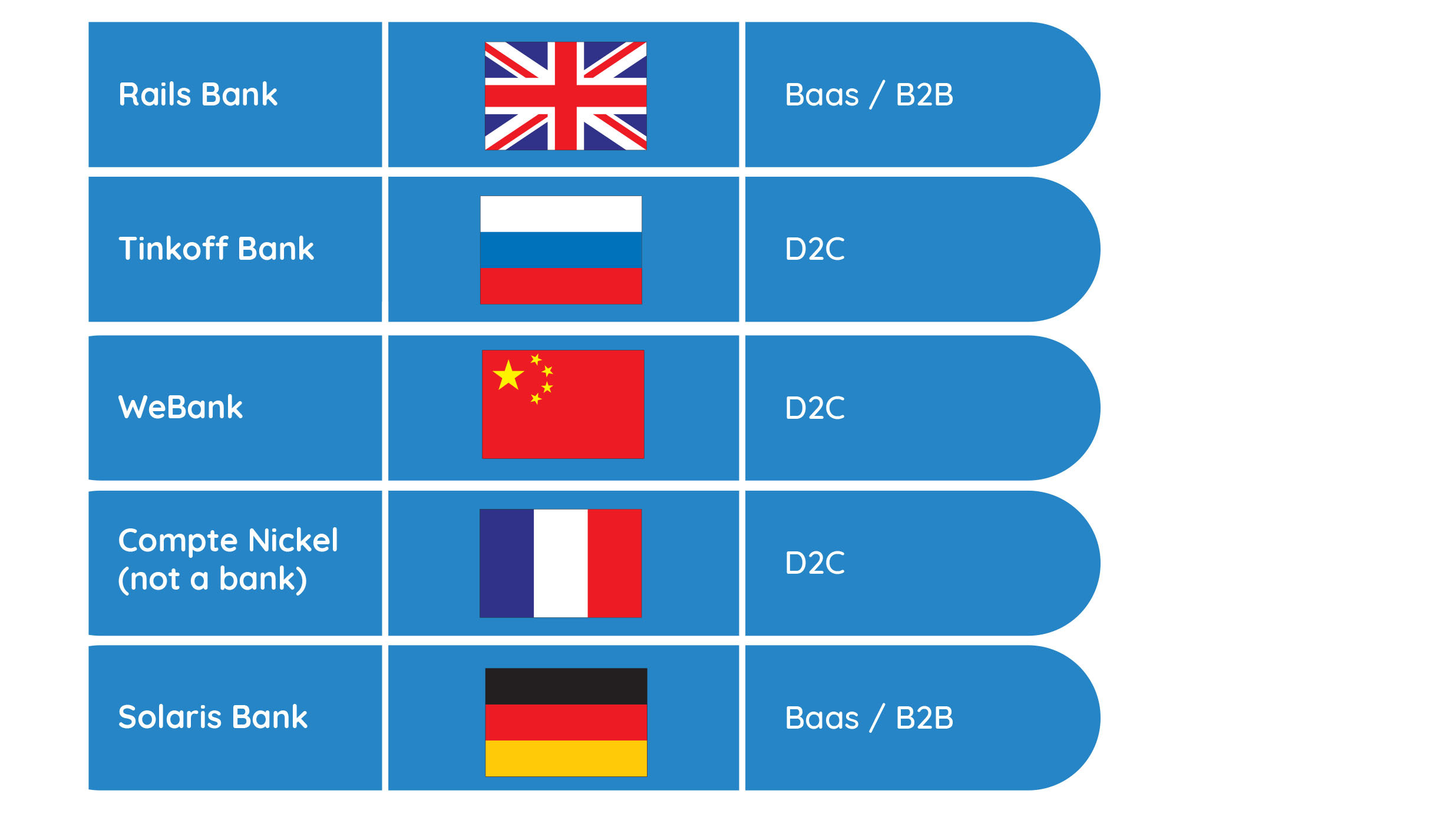

Flag 3 : Growing up!

Open banking examples

Fintechs offering banking services

Examples of grown-up open banking fintechs offering banking services

Source: Findexable 2021

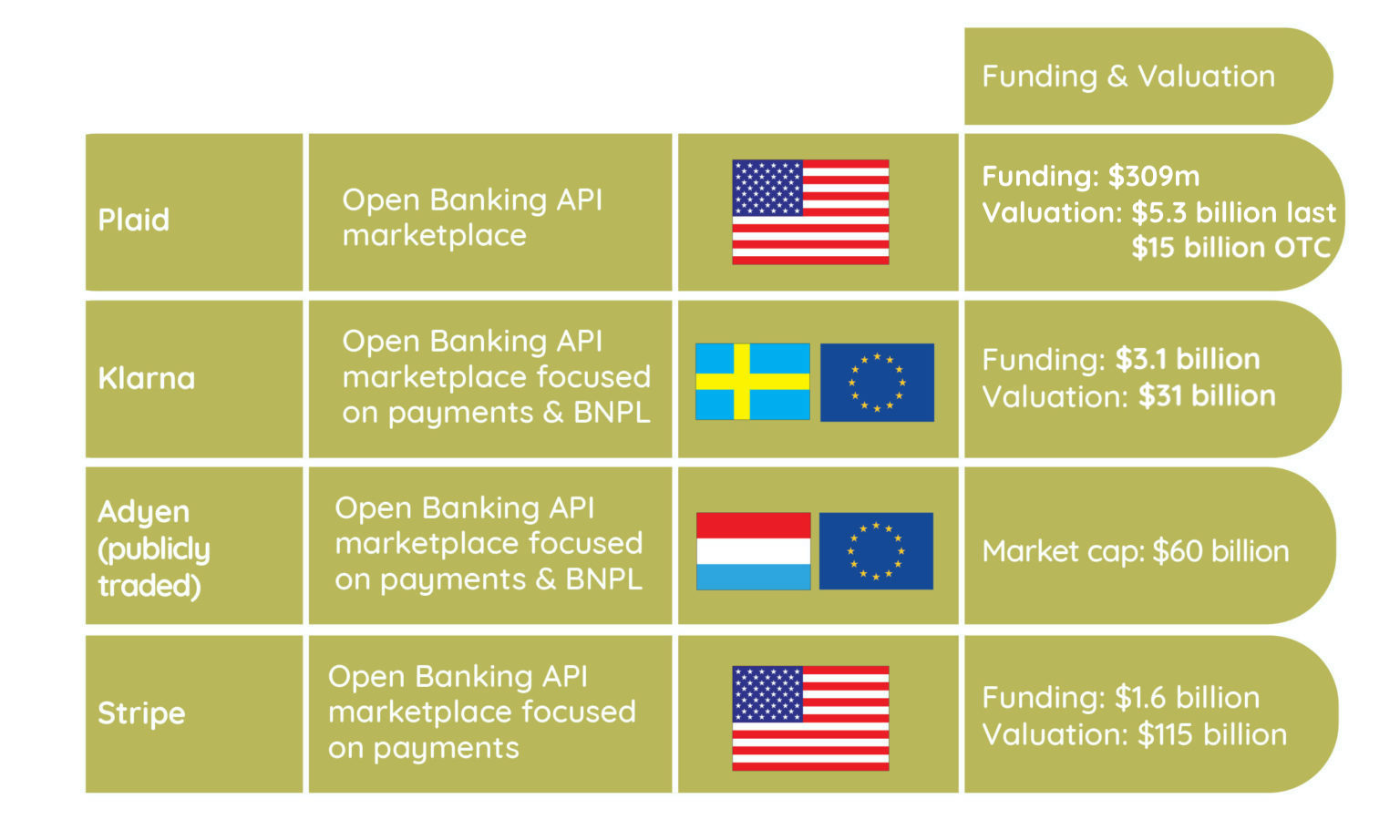

Fintech API-first enablers of open banking

Source: Findexable 2021

Fast-growing open banking fintech enablers

Source: Findexable 2021

Register here for Finastra Universe – and hear from over 100 sessions on how finance is opening up and how you can accelerate through change.