Meet the Fintech Diversity Radar champions

In this series, we’ll be featuring the women and men who are supporting the Fintech Diversity Radar initiative and improve the understanding of the contribution of diverse teams to company success. In this edition, Dr Jane Thomason, Co- founder of the British Blockchain and Frontier Technology Association, focuses on gender equality, the female economy and improving women’s access to financial services.

Why fintech diversity is vital for building the global economy

Why fintech diversity is vital for building the global economy

By Dr Jane Thomason, Co-founder of the British Blockchain and Frontier Technology Association

During International Women’s Month 2021, the theme #choosetochallenge inspires us all to challenge the barriers to achieving Sustainable Development Goal 5, gender equality, a fundamental human right, and a necessary foundation for a peaceful, prosperous and sustainable world. There is also growing evidence that women’s equality makes good economic sense.

McKinsey Global Institute found that $12 trillion could be added to global GDP by 2025 by advancing women’s equality.

The Harvard Business Review encourages investors to pay attention to the female economy, as women control about $20 trillion in annual consumer spending and women represent a growth market bigger than China and India combined. Shelly Porges of the Billion Dollar Fund for Women says, “Women are innovating across the board in areas ranging from FemTech, cleantech, fintech, agtech, etc. to Saas, CPG, AI/ML, Robotics, Blockchain, Cannabis etc.”

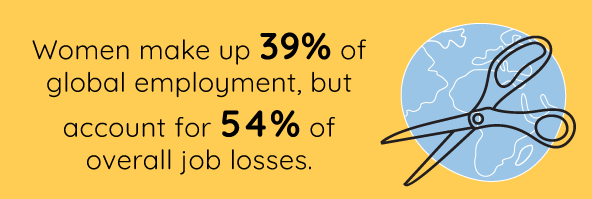

There has never been a more important time to address women’s equality, with the regressive impacts of the COVID-19 pandemic. While the impact of the pandemic is unknown, based on SARS which cost the global economy around $50 billion, and MERS costing $8.5 billion, it is likely to be profound. The World Bank predicts that up to 100 million people may fall into extreme poverty, the first increase since 1998. Global remittances, a critical development finance flow, have also fallen during the pandemic due to job losses for migrant workers. According to the United Nations Network on Migration, remittances are expected to see the sharpest decline in recent history, falling by 19.7% to around $445 billion, compared to $554 billion in 2019. McKinsey further reports that women’s jobs are 1.8 times more vulnerable to this crisis than men’s jobs.

There has never been a more important time to address women’s equality, with the regressive impacts of the COVID-19 pandemic. While the impact of the pandemic is unknown, based on SARS which cost the global economy around $50 billion, and MERS costing $8.5 billion, it is likely to be profound. The World Bank predicts that up to 100 million people may fall into extreme poverty, the first increase since 1998. Global remittances, a critical development finance flow, have also fallen during the pandemic due to job losses for migrant workers. According to the United Nations Network on Migration, remittances are expected to see the sharpest decline in recent history, falling by 19.7% to around $445 billion, compared to $554 billion in 2019. McKinsey further reports that women’s jobs are 1.8 times more vulnerable to this crisis than men’s jobs.

According to the Center for Financial Inclusion, access to financial services is a key enabler for women to achieve financial independence and economic empowerment. Women in developing economies are 9% less likely to have a bank account than men (World Bank), 8% less likely to own a mobile phone (GSMA), and 7% less likely to be literate (Vital Voices Global Partnership). According to the OECD, increased investments in women’s economic participation are vital because women typically invest a higher proportion of their earnings in their families and communities than men. Women need access to the full range of credit, banking and financial services and facilities essential to more fully develop their assets, their land and their businesses.

According to the Center for Financial Inclusion, access to financial services is a key enabler for women to achieve financial independence and economic empowerment. Women in developing economies are 9% less likely to have a bank account than men (World Bank), 8% less likely to own a mobile phone (GSMA), and 7% less likely to be literate (Vital Voices Global Partnership). According to the OECD, increased investments in women’s economic participation are vital because women typically invest a higher proportion of their earnings in their families and communities than men. Women need access to the full range of credit, banking and financial services and facilities essential to more fully develop their assets, their land and their businesses.

Fintech has the power to remove barriers, increase access to financial services among poor and marginal communities, and link the digital economy together, and will play an essential role in the economic recovery in 2021 and beyond. The Gender Lens Investing Initiative focuses on investing with the intent to address gender issues or promote gender equity. Forbes lists the following powerful arguments about why to invest in women:

- Private technology companies led by women are more capital-efficient, achieving 35% higher ROI, and, when venture-backed, 12% higher revenue than startups run by men, according to the Kauffman Foundation.

- Women-founded companies in First Round Capital’s portfolio outperformed companies founded by men by 63%.

- In a study of over 350 startups, Mass Challenge and BCG determined that businesses founded by women deliver higher revenue – more than two times as much per dollar invested – than those founded by men.

- Companies with strong women leadership generated a return on equity of 10.1% per year versus 7.4% for those without strong women leadership, according to MSCI ESG Research.

- Alison Rose, Deputy CEO of NatWest, issued a report earlier this year that estimates the UK economy could see a £250 billion boost over the next ten years if female entrepreneurship were to be embraced at the same rate as male entrepreneurship.

- According to The State of Women in Tech 2020 report, Fortune 500 companies with at least three female directors have seen their return of invested capital increase by at least 66%, their return on sales increase by 42%, and their return on equity increase by at least 53%.

The Financial Alliance for Women maintains that fintechs are in a unique position to enable change and create the low-cost, time efficient, high-value and sustainable financial solutions that women need in the more than $216 trillion economy that they control. Fintechs that benefit women and are owned or led by women make good economic sense. However, The Fintech Times reports that progress is far from notable when it comes to tackling gender equality. In the UK, only 17% of fintech companies have female founders and women account for less than 30% of the sector’s overall workforce. In addition, women receive just 3% of VC funding in the sector. Yet, female-led fintechs are more likely to serve female clients, they are more likely to co-create products and solutions with female customers and deploy effective marketing strategies to onboard women.

To address this gap, the Fintech Diversity Radar is a global initiative to benchmark the role of women in scaling fintech firms and incumbent institutions. The Fintech Diversity Radar will build the world’s first dataset on gender diversity in global fintech to enable scaling companies and incumbent peers to benchmark progress and identify measurable steps to improve. The initiative will: map the global fintech landscape to identify how, and where, women are employed and assess progress; advance the employment of women in fintech globally by identifying practical actions to improve gender balance; build a roadmap for the advancement of female entrepreneurship in advanced and high-growth markets; identify the cause and effect of success in serving female customers and highlight which countries, regions and firms are out-performing.

The faster we push for greater gender equality, as the COVID-19 crisis continues, the bigger the benefits will be for economic growth. A data-driven, tailored approach like the Fintech Diversity Radar will help to identify gaps, obstacles and ultimately solutions to increasing investment in women-owned fintechs and fintech products for women.

|

We want to know what you thinkPlease help us fill in the data gaps on diversity in fintech globally. |