CORE BANKING

Rooting for the core?

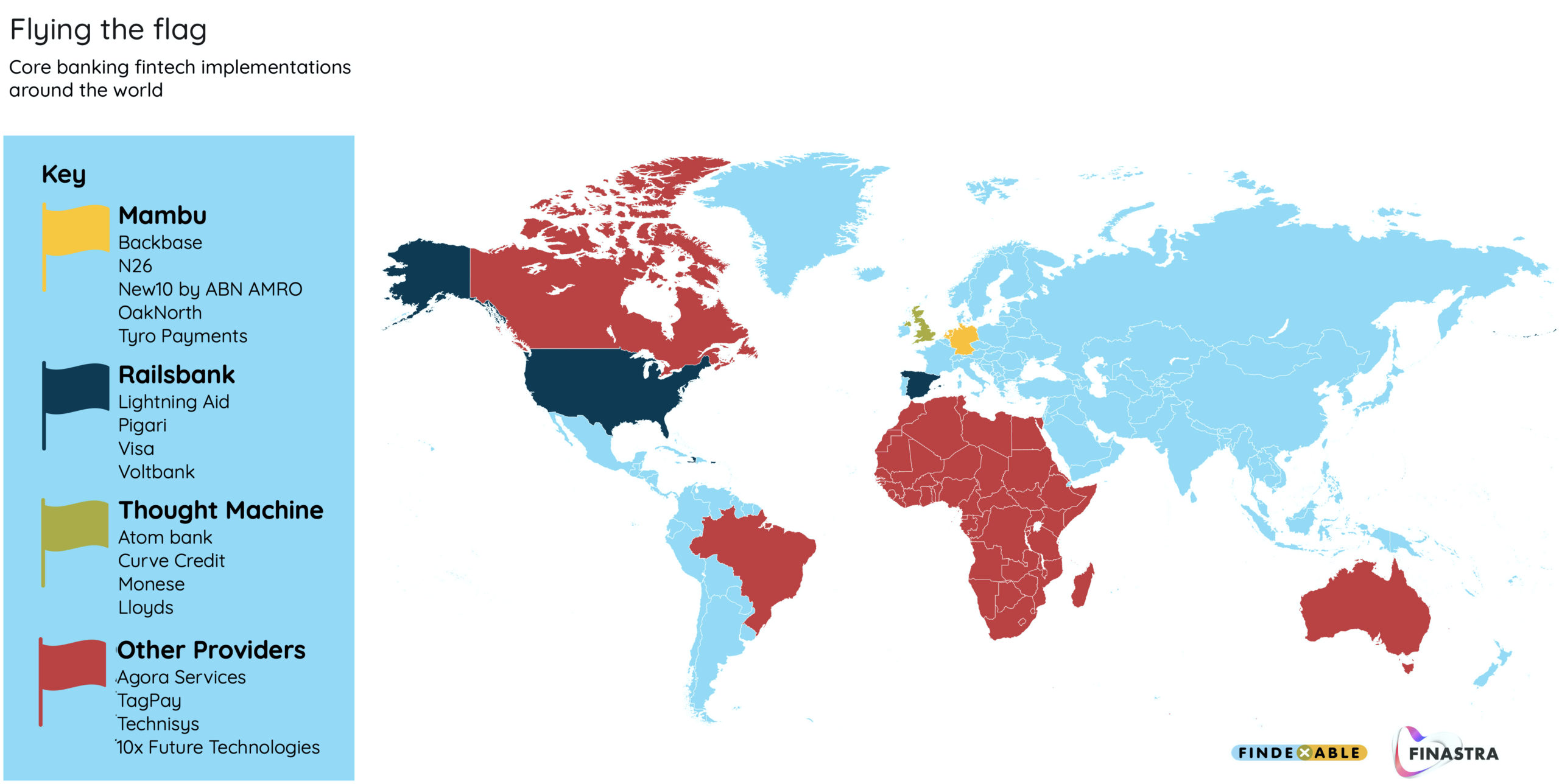

Next gen core banking providers find their feet – and start flying the flag

Despite its association with archive 1970s TV footage of closet-sized mainframe computing, fintechs are proving that core banking is anything but boring.

Author: Dr Efi Pylarinou

In this research short…

- Global implementation map

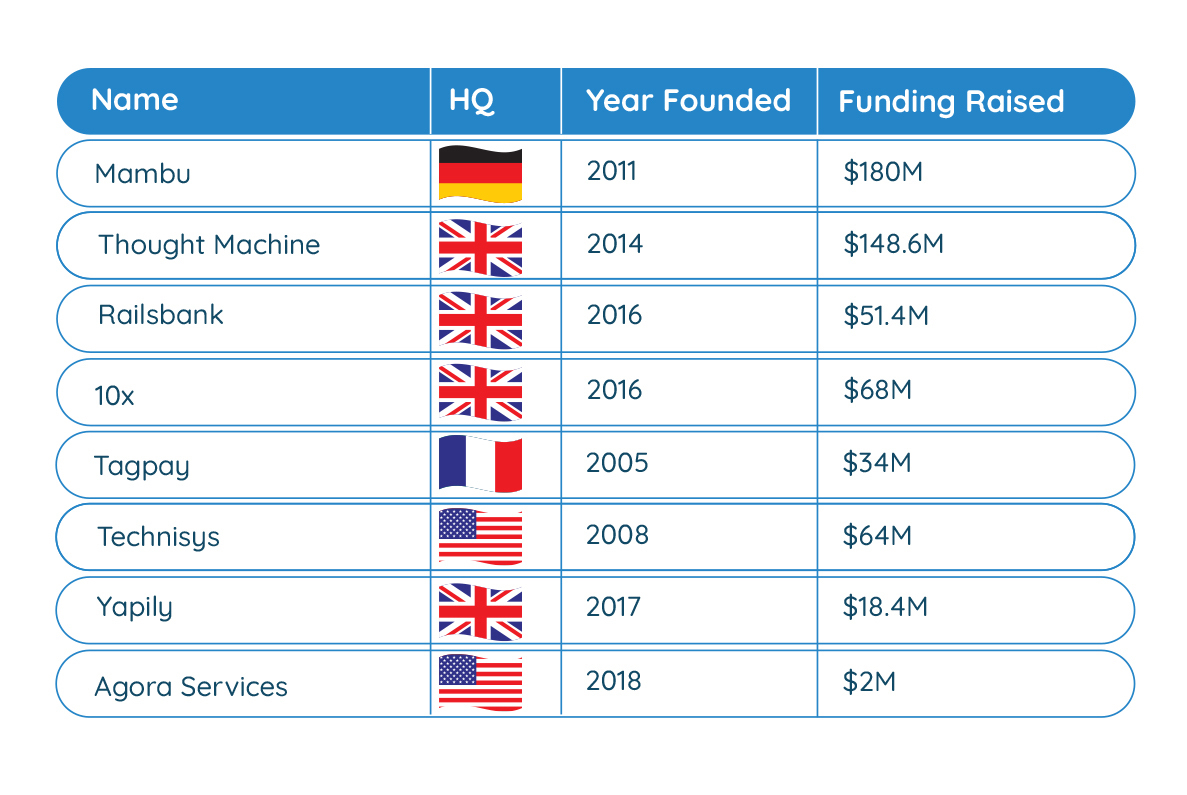

- Core banking innovators

- Core banking fintech funding

Rooting for the core

Getting the right core banking infrastructure, is essential to building an agile, digital financial services business. Luckily for incumbents or scaling fintechs there’s a solution for that – fintech innovators are unbundling every imaginable component of core banking and digitizing it, increasingly building on the cloud and designing it with an API first modular mindset.

The pace of innovation behind the scenes is relentless. Look at one arcane area of the brokerage business, custody and clearing where innovators, like Apex Clearing and DriveWealth to name two, are focused on seamless account opening, account funding, and trading of shares, that can be plugged into any financial business wanting to add investment services to its offering.

Core blimey

Core banking is an umbrella term. Core banking may focus on serving a particular segment, like retail or small businesses, or any size of corporate. It can be focused only on payments, the core of economic activity, or scaled to include deposits, loans and trading.

For any of these business lines, core banking activities start with KYC, customer onboarding, account opening, transaction management. Then it may include, interest rate calculations, credit processing, and other life-cycle management processes depending on the financial contract managed.

Why the landgrab?

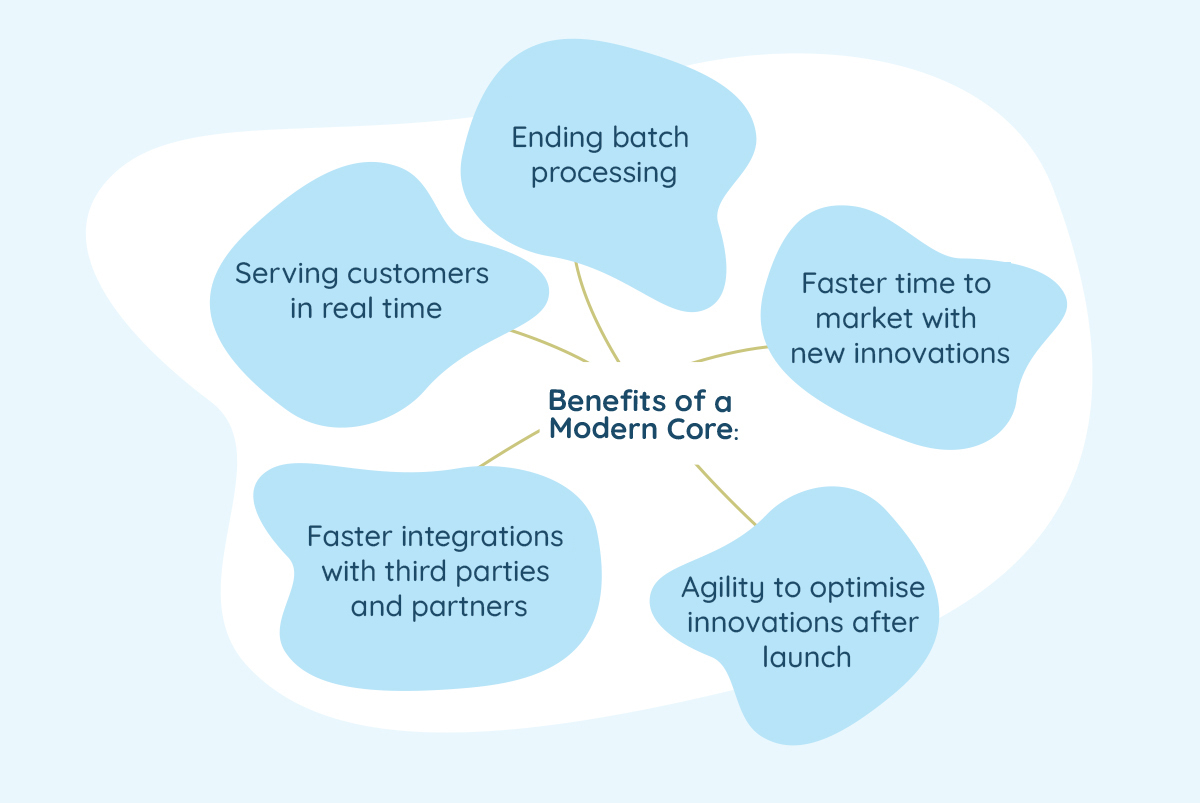

It’s hard to overestimate the benefits of building a modern core infrastructure – particularly for incumbents. These include:

- Ending batch processing

- Faster time to market with new innovations

- Agility to optimise innovations after launch

- Faster integrations with third parties and partners

- Serving customers in real time

…even the flexibility to update the business model as the market shifts. Banks everywhere should be rooting for the core if they’re serious about building digital-first businesses.

View our implementation map to see what core banking fintechs are doing where and how they’re taking on the world.

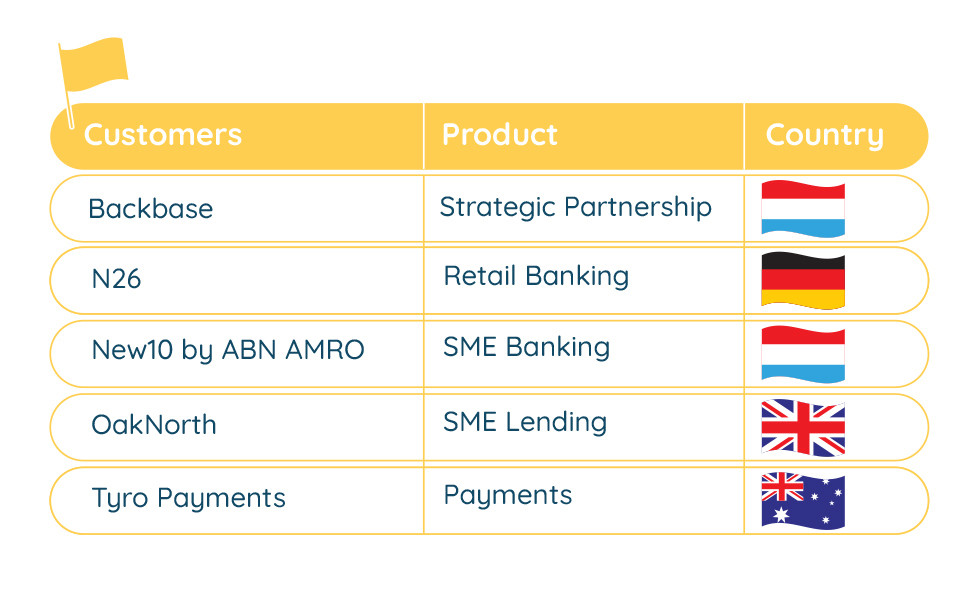

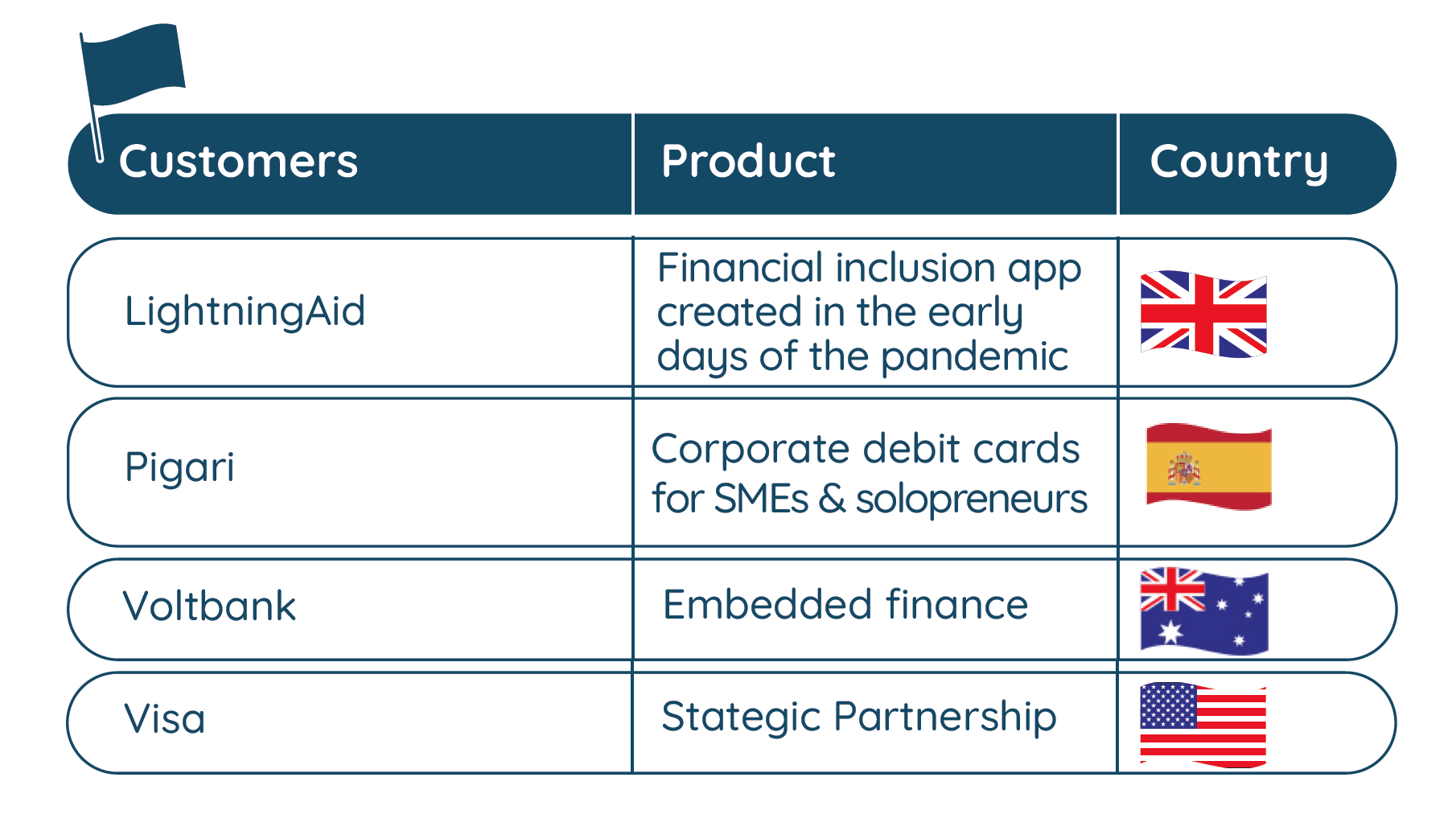

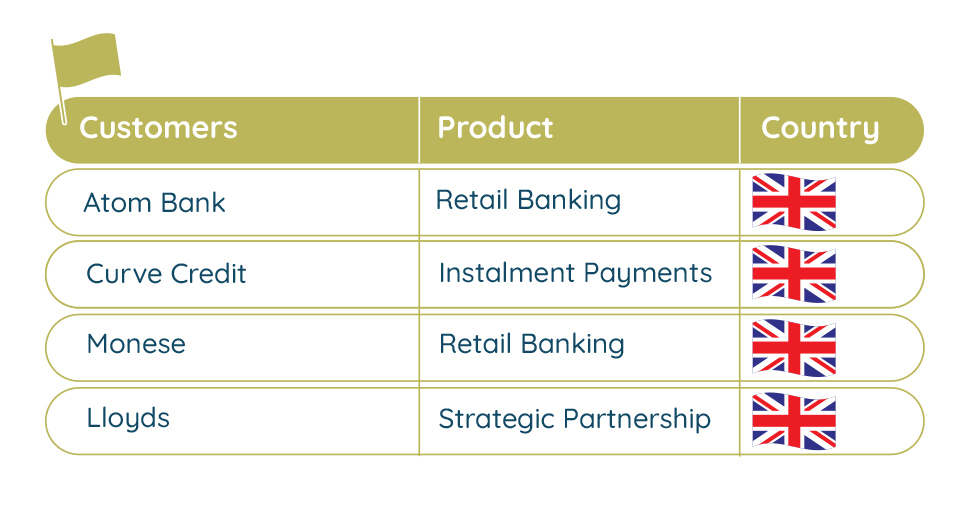

Flag 1: Next gen core banking providers and live business cases

Most of the headlines on the core banking fintechs have been taken up by Mambu, Thought Machine and Railsbank so far – but there are others out there…

Mambu

HQ: Berlin, Germany

Tagline: Composable Banking. Be built for change.

Focus: Major focus on lending technology

Source: findexable 2021

Railsbank

HQ: London, UK

Tagline: Global Open Banking Platform

Focus: BaaS, first credit card as a service provider

Source: findexable 2021

Thought Machine

HQ: London, UK

Tagline: Core Banking Software. Cloud Native

Focus: Retail, SME banking

Source: findexable 2021

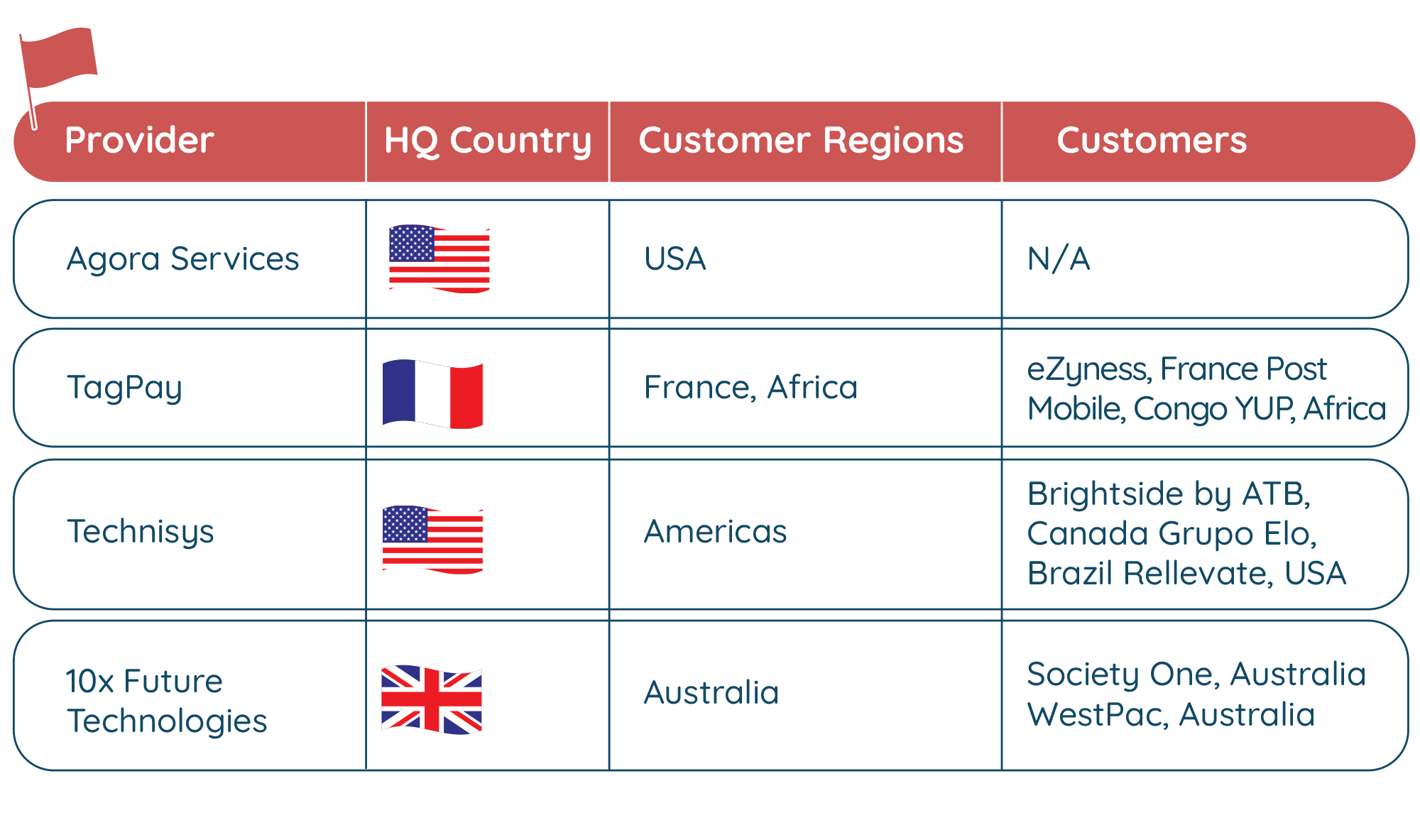

Flag 2: Other providers

Source: findexable 2021

Core (banking) values

As core banking fintechs grow, attention is turning to their ability to scale into the incumbents enterprise tech firms of the future. Funding pipelines have been healthy so far (Flag 3 below).

Public market appetite for this type of deep enterprise tech also appears healthy. US-based nCino is a publicly traded next gen core banking provider. The company IPO’d on Nasdaq in July 2020 at $31 per share and raised $245 million. It’s currently trading around $70 with a market capitalization of $6.5Billion.

nCino was founded one year after Mambu which has just turned 10 and is currently the most valuable private next gen core banking provider. Mambu’s latest round was in January (€110million) at a valuation of €1.7Billion ($2.1Billion).