APIs & DIGITAL TRANSFORMATION

API-yi-yay? Data, Bezos, and Feng Shui

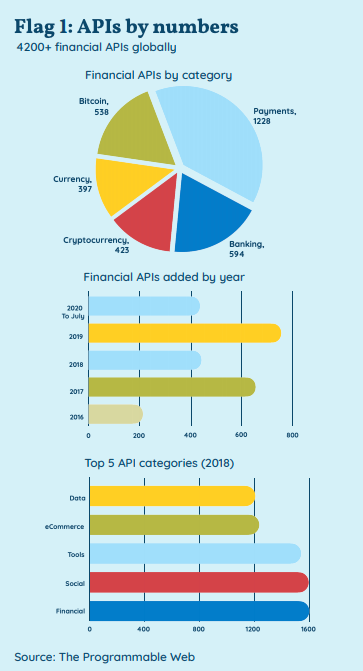

APIs are the denim of the digital age – they’re everywhere. With over 4,000 financial services APIs, and counting, they’re transforming how data flows across the marketplace. But as Amazon proved digital transformation starts at home. Using APIs to drive internal transformation is as important as the latest millennial-friendly app…

Dr Efi Pylarinou

Feng Shui was all the rage in the 90s. Although not trending now, large corporations continue to spend on business Feng Shui consultants to improve internal communication, teamwork, alignment and more. From rearranging workspaces to adapting sustainability principles at work, mindfulness and more, so that internally, energy ‘flows better’.

Global financial services firms like Morgan Stanley, HSBC, the Bank of China, are Feng Shui business customers.

By replacing the concept of ‘energy’ with ‘data’ or data analytics the principle of Feng Shui has a lot to teach financial services organisations of any size. Internal Feng Shui-style transformations have the potential to remove barriers to internal communication and dismantle organisational siloes. How? Jeff Bezos’ firmwide principle may hold the answer.

By replacing the concept of ‘energy’ with ‘data’ or data analytics the principle of Feng Shui has a lot to teach financial services organisations of any size. Internal Feng Shui-style transformations have the potential to remove barriers to internal communication and dismantle organisational siloes. How? Jeff Bezos’ firmwide principle may hold the answer.

Firm-wide principle for financial businesses of any size: `All Internal communications are strictly via API calls. Data can only flow through program interfaces that involve no intervention, no duplication, no human error.`

This kind of internal transformation can automatically create a Feng Shui transformation – by helping to remove stagnant or unstable energy so that data flows across the organisation can move without interruption.

Value-generating digitisation

If applied consistently this approach will create long-term value. Kicking off the kind of ground-up redesign that can enable new value streams to form, new customer engagement experiences with the potential to unlock the network effects of platform business-models.

It’s not just large organisations with their big datasets that can benefit from applying Feng Shui thinking to their data and analytics strategy, although there are good examples of incumbent approaches to this – see Flag 4 below. It is equally relevant to smaller or more narrowly focused businesses.

Flag 2: API-way… or the highway: The Amazon Edict

After surviving the 2000 dot com crash in 2002 Jeff Bezos, sent an internal memo to all employees with a clear message:

“Anyone who doesn’t do this will be fired. Thank you; have a nice day!”

1. All teams will henceforth expose their data and functionality through service interfaces.

2. Teams must communicate with each other through these interfaces.

3. There will be no other form of inter-process communication allowed: no direct linking, no direct reads of another team’s data store, no shared-memory model, no back-doors whatsoever. The only communication allowed is via service interface calls over the network.

4. It doesn’t matter what technology they use. – (tech neutral).

5. All service interfaces, without exception, must be designed from the ground up to be externalizable. That is to say, the team must plan and design to be able to expose the interface to developers in the outside world. No exception.

Data-rage

Bezos was clearly a visionary. Today, some 20 years later, although the importance of data and data analytics is a business cliché, financial services firms are still grappling with their data strategy and how to leverage firm-wide datasets to identify synergies.

It’s easy to understand why. Tighter regulation as well as security and compliance issues throw up obstacles that make the sight lines across the organization particularly challenging. Then there’s the external competition. Legions of lean, agile fintech start-ups – while not an existential threat – pose challenges across multiple layers of financial services activity. There are now well over 4,000 financial services-related APIs – and counting. Fintech, payments and cryptocurrency APIs are among the fastest growing segments of the API economy. And the pace of growth will increase as more regions embrace the open finance wave.

Feng Shui personal consultants – and their pandemic-era equivalent Marie Kondo – commonly advise: “Start with your closet”. In other words, start with your internal Feng-Shui-inspired transformation and when that’s completed, the efficiencies – in internal productivity, employee satisfaction and in better customer servicing – will follow.

Good housekeeping?

Understandably as rules around data protection get tighter, incumbent financial services firms want to move away from screen-scraping (scraping data from websites from third parties or internally).

And rightly so. As the API economy grows in size and influence it’s becoming the only path for incumbents and Fintechs to launch embedded finance businesses or forge partnerships with third parties in e-commerce or big tech.

And rightly so. As the API economy grows in size and influence it’s becoming the only path for incumbents and Fintechs to launch embedded finance businesses or forge partnerships with third parties in e-commerce or big tech.

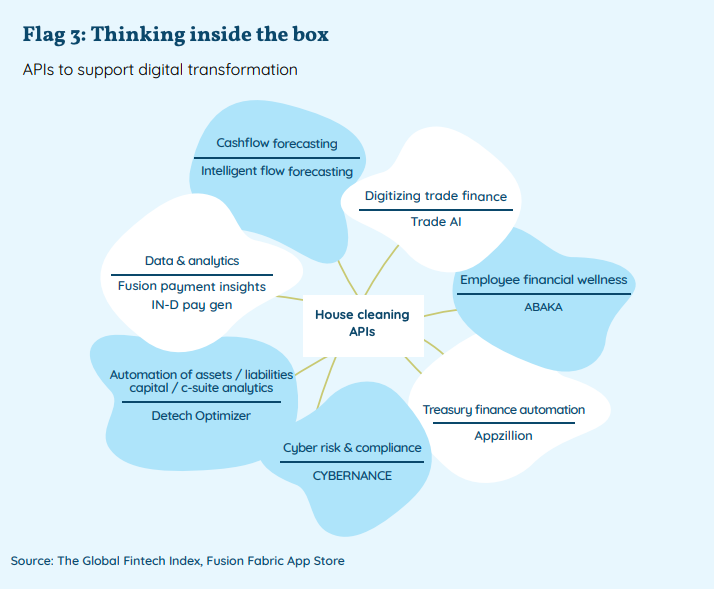

Using APIs to clean house is increasingly the new normal. In the (near) future it’s the only way to become digitally native and resilient. And as DBS, BBVA or Societe Generale prove the market is moving in that direction.

Changing Platforms?

The platform approach to financial services has not gone unnoticed by incumbent core banking and infrastructure tech providers. Among them Finastra, talking to us before the company’s annual Finastra Universe client event to discuss how technology can digitize banking, is focusing on how the firm can become an enabler of this kind of Feng-Shui-inspired transformation.

“When it comes to machine learning, API calls have tremendous benefit internally and externally. By exposing data as a service, we can communicate across different lines of business. If I am on a lending team and I need data from a retail banking team, a simple API call can allow me to access this data instantaneously. The old school approach of reaching out to the team and getting access to a database or a set of flat files is a backwards approach as it is highly repetitive when other data science teams will be reaching out for the same sets of data. An API service allows us to authenticate and access cross-organizational data easily” says Adam Lieberman, Finastra`s Head of AI & ML.

One benefit of the growing API economy is that organisations no longer have to fight their own battles. By connecting to one of a growing number of financial services app stores some of the hard work to kick off the process of house cleaning has already been done – from payments to cyber, analytics, compliance and employee management (See Flag 3 above). “The Feng Shui approach applied to data and analytics is a smart way to achieve efficiency throughout your organization as a whole” says Mr Lieberman. Gradually it seems the financial services industry is learning to leave behind the legacy and clear out its closets for a digital, data-enabled future.

Flag 4: Clean House!

How are large institutions using APIs in their organisations?

Firm: DBS Bank

Theme: Regulation & compliance

API strategy

Singapore-based DBS Bank has a mature API offering platform. The DBS Bank platform was launched in late 2017 and now counts over 200 APIs across a variety of categories (payments, rewards, fund transfers and credit).

Using API’s to drive compliance

Cube, born out of the DBS accelerator, offers an API-first approach for management of regulatory change and intelligent compliance and is used internally by DBS Bank. Cube`s machine learning & natural language processing expertise offer efficiencies because DBS Bank has an internal data architecture that has no blockages.

Firm: Societe Generale

Theme: Legal & contract management

API strategy

Societe Generale launched the Innovation Insiders Series in 2020 to share the bank’s internal transformation efforts. As an institution operating in over 60 countries and multiple business lines (including retail banking, private banking, corporate banking), their internal innovation goals are large scale.

Managing contracts through APIs

Claire Calmejane, their Chief Innovation Officer, highlighted their API-first `Legal Assistant` that interfaces across multiple departments at the banks to process thousands of legal documents – from NDAs to ISDA agreements, recognizing clauses and data before final sign-off by a staff member.

Dr. Efi Pylarinou – was ranked No.1 Global Woman Influencer in Finance & the Data conversation by Refinitiv 2019 & 2020.

1. https://fengshuiservices.com/corporate-feng-shui/

2. API Bezos manifesto